Are you looking for Co-Branded Credit Card? If Yes, You are at the right place.

In this article, We are sharing all the information about What Is a Co-Branded Credit Card?.

Co-branded credit cards are created through partnerships among retailers, card issuers, and credit networks. A co-branded credit card could be the right choice for you if you are frequently shopping at Amazon or flying with Delta. Such cards offer extra rewards for certain purchases or, in some cases, for any purchases. You can often access exclusive benefits and perks through co-branded credit cards, as well.

The first co-branded credit card appeared in the mid-1980s when an airline teamed with a bank to produce a gold Mastercard. Co-branded credit cards have since been issued by many global airlines, hotel chains, and retailers to reward loyal customers. Many types of credit cards reward cardholders with cash back or points, discounts and other benefits from the brands they love.

The co-branded credit card is becoming more and more popular these days. Among the major travel and retail brands with co-branded credit cards are Delta Air Lines, Walmart, and Amazon. But newcomers such as Instacart and DoorDash are also in the race.

A co-branded credit card is offered by a bank or issuer in collaboration with a brand. Among the benefits of using these cards is the ability to offer exclusive discounts, cashback offers, and loyalty points on brand purchases. These cards can be used online and offline, just like regular credit cards.

The co-branded credit cards available to you depend on your needs and lifestyle. It is, however, important that you are aware of the benefits and drawbacks of one before buying one.

What is a Co-Branded Credit Card?

Contents

- 1 What is a Co-Branded Credit Card?

- 2 How Co-Branded Cards Work?

- 3 Best Co-Branded Credit Cards

- 4 How To Get a Co-Branded Credit Card?

- 5 Video Guide For Co-Branded Credit Card

- 6 What Are Some Precautions to Consider For Co-Branded Credit Cards?

- 7 Is It a Good Idea to Get a Co-Branded Credit Card?

- 8 Pros and cons of co-branded credit cards

- 9 Advantages of Co-Branded Credit Cards

- 10 How Co-branded Cards Are Different from Regular Cards

- 11 How Do Co-Branded Cards Affect Your Credit Score?

- 12 What Are the Alternatives to Co-Branded Credit Cards?

- 13 FAQs

A co-branded credit card is issued by a financial institution partnering with another company, organization, or brand, usually a bank. Still, it can also be a credit union or fintech company. Most of these credit cards offer brand-specific rewards and benefits. Among the perks you will receive are rewards, exclusive discounts, free shipping, etc.

Credit cards, whether regular or co-branded, do not differ significantly from one another from the standpoint of a consumer. If there is a balance on the card, card members pay off the balance every billing cycle. The co-branded cards can also be used anywhere that accepts credit cards.

How Co-Branded Cards Work?

A co-branded credit card works just like any other credit card. The cards are accepted anywhere that accepts cards from that network, such as Mastercard, Visa, American Express, or Discover.

There are several ways in which co-branded cards can be structured. Co-branded credit cards are issued by merchants, including department stores, gas stations, airlines, or other organizations, such as universities and nonprofits, partnering with financial institutions which provide the credit.

It is often the bank where the retailer or other business maintains a merchant account, which already accepts credit and debit card payments. The financial mechanics of transactions are handled by third parties, even when retailers offer proprietary credit cards. For this reason, you might write a check to ABC store or XYZ bank when paying a store charge bill.

Best Co-Branded Credit Cards

Amazon Prime Visa card

Amazon Prime Visa rewards cards come with an Amazon gift card worth $100 or more upon approval. As a member of Amazon Prime, you’ll earn 5 percent back at Amazon.com, Amazon Fresh, and Whole Foods Market; 2 percent back at restaurants and gas stations; and 1 percent back on everything else.

The Amazon Prime card has no annual or foreign transaction fees, but to get the most value, you’ll need to be an Amazon Prime member, which costs $139 a year. The card is unlikely to cause you to buy a Prime membership, but it can be useful if you already have one.

Citi/AAdvantage Platinum Select World Elite Mastercard

It’s one of the best co-branded airline credit cards, if not the best, thanks to all its benefits, but you’d need to fly American Airlines frequently to take advantage of it. A $0 intro annual fee is offered for the first year, and $99 after that, and 50,000 points are awarded after spending $2,500 in the first three months.

When you make an eligible American Airlines purchase, you’ll receive 2X miles, 2X miles at gas stations and restaurants, and 1X on all other eligible purchases. With this card, you’ll get free first-checked bags on domestic flights, preferential boarding, and 25 percent off eligible in-flight food and beverage purchases for up to four companions travelling on the same reservation.

Hilton Honors American Express Aspire Card

It is often considered one of the best co-branded hotel cards despite its high annual fee of $450. There are numerous perks, such as complimentary Breakfast credit, Executive lounge access (depending on the brand and region), free premium Wi-Fi, and daily food and beverage credit if you enjoy Diamond status – the most elite Hilton status.

A new cardmember can earn 150,000 Hilton Honors points after spending $4,000 on the card within three months of activation. The card also earns 14X points at participating Hilton hotels and resorts, 7X points on flights booked directly with airlines or through the American Express Travel portal, 7X points on car rentals booked directly with selected car rental companies, 7X points on dining out in the U.S., and 3X points on all other purchases.

How To Get a Co-Branded Credit Card?

The application process for co-branded credit cards typically resembles traditional credit cards. A cardholder can apply online through the issuer’s website, in-store, or even in the air while flying.

As card issuers handle co-branded credit cards, you can expect a hard credit check. Before applying for your preferred card, research what credit score is recommended.

Visit the website of the card issuer to find preapproval tools. Your credit score won’t be negatively affected by checking if you’re preapproved, and you can determine whether you qualify.

Video Guide For Co-Branded Credit Card

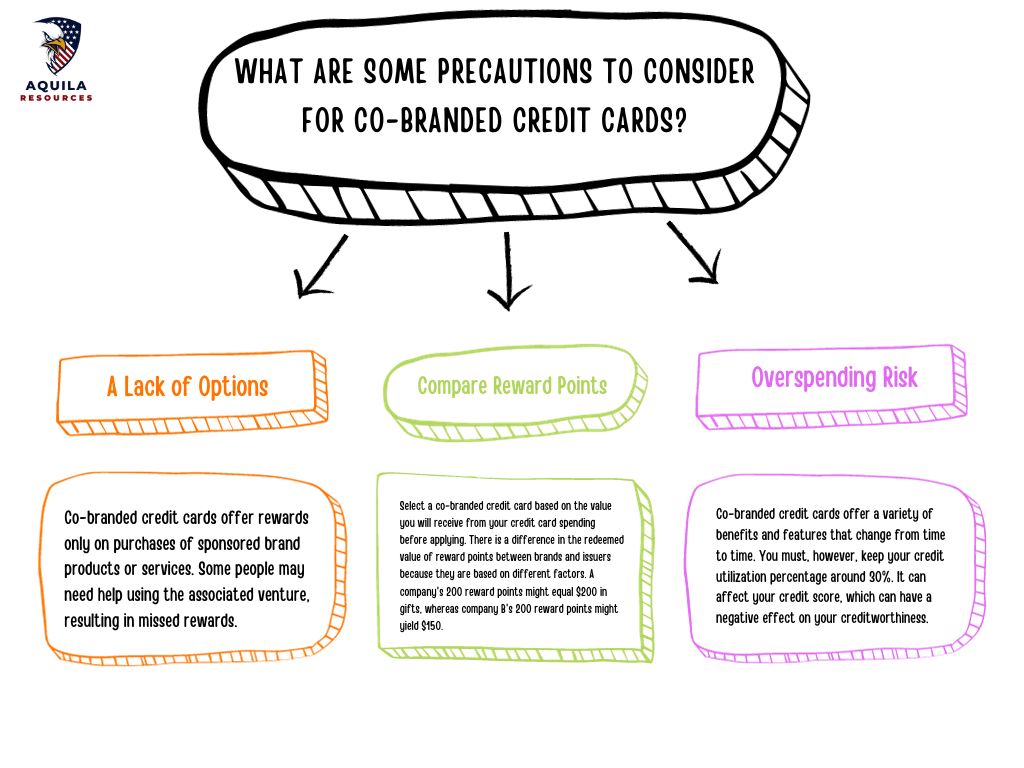

What Are Some Precautions to Consider For Co-Branded Credit Cards?

A Lack of Options

Co-branded credit cards offer rewards only on purchases of sponsored brand products or services. Some people may need help using the associated venture, resulting in missed rewards.

Compare Reward Points

Select a co-branded credit card based on the value you will receive from your credit card spending before applying. There is a difference in the redeemed value of reward points between brands and issuers because they are based on different factors. A company’s 200 reward points might equal $200 in gifts, whereas company B’s 200 reward points might yield $150.

Overspending Risk

Co-branded credit cards offer a variety of benefits and features that change from time to time. You must, however, keep your credit utilization percentage around 30%. It can affect your credit score, which can have a negative effect on your creditworthiness.

Is It a Good Idea to Get a Co-Branded Credit Card?

Co-branded credit cards sound exciting, especially with all the rewards and cashback they offer. It provides the customer with a partial benefit from the co-merchants or brands. They can be beneficial at times and can be a great advantage for frequent travellers. These offers might tempt you to own multiple credit cards, but it’s important to stay focused.

Multiple credit cards mean multiple bill payments, and defaulting on these payments harms your credit score. Furthermore, if you have an increased credit limit and lucrative offers, you may spend more than you should. Thus, you should be cautious when applying for a co-branded credit card. Keep your credit limit under control and take advantage of loyalty rewards.

Pros and cons of co-branded credit cards

Pros

- An exclusive brand can offer rewards, discounts, and other valuable benefits.

- Credit cards with co-branding, such as airline or hotel cards, can help cardmembers achieve elite status and unlock even more benefits.

- A co-branded credit card might make it easier to get approved – but it’s never guaranteed.

Cons

- When you use a brand-specific co-branded credit card, you may be limited in where you can earn or spend rewards.

- It may be tempting to overpay to earn or redeem exclusive rewards.

- There is no warning required when a company devalues rewards.

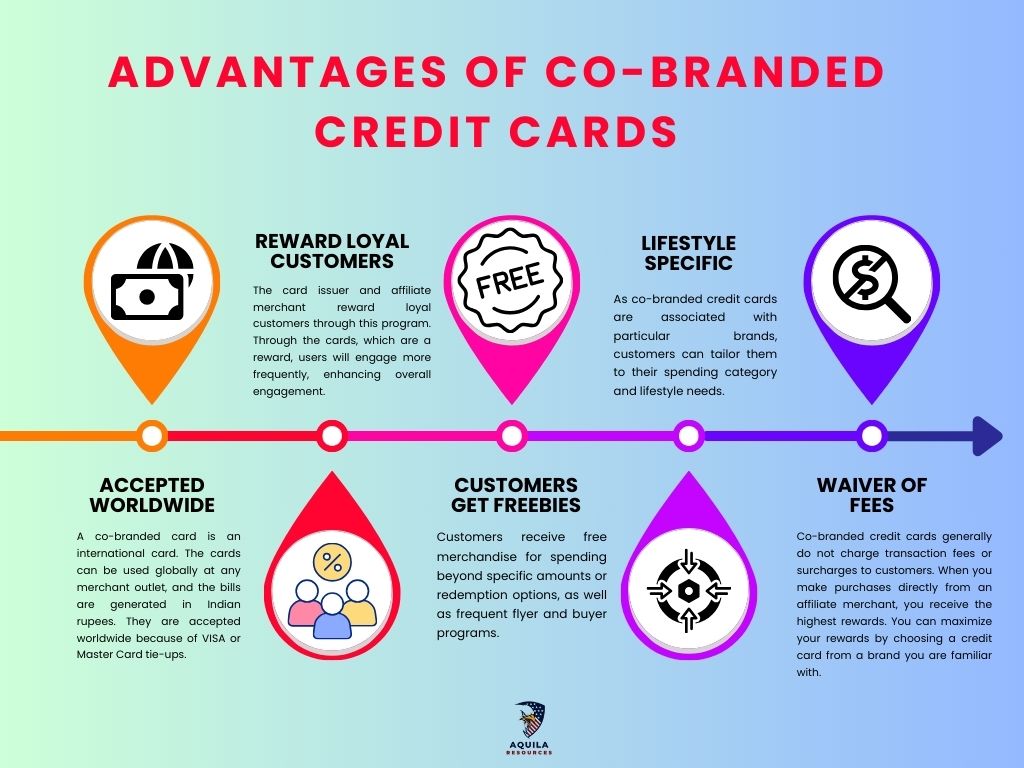

Advantages of Co-Branded Credit Cards

Accepted Worldwide

A co-branded card is an international card. The cards can be used globally at any merchant outlet, and the bills are generated in Indian rupees. They are accepted worldwide because of VISA or Master Card tie-ups.

Reward Loyal Customers

The card issuer and affiliate merchant reward loyal customers through this program. Through the cards, which are a reward, users will engage more frequently, enhancing overall engagement.

Customers Get Freebies

Customers receive free merchandise for spending beyond specific amounts or redemption options, as well as frequent flyer and buyer programs.

Lifestyle Specific

As co-branded credit cards are associated with particular brands, customers can tailor them to their spending category and lifestyle needs.

Waiver of Fees

Co-branded credit cards generally do not charge transaction fees or surcharges to customers. When you make purchases directly from an affiliate merchant, you receive the highest rewards. You can maximize your rewards by choosing a credit card from a brand you are familiar with.

How Co-branded Cards Are Different from Regular Cards

Credit cards with co-branding are similar to regular credit cards. When you use the card, you are only able to enjoy a memorable shopping experience at the merchant that is sponsoring it. There may also be a logo of the merchant on the card. Using a regular credit card should also be done with caution and restraint. Comparing credit cards from different companies can help you determine which offers the most benefits.

How Do Co-Branded Cards Affect Your Credit Score?

Co-branded credit cards can benefit your credit score if you use them responsibly, just as other credit cards do. Your credit utilization ratio can be described as the amount of debt you have at any given point and the payment of your bill on time each month. Only apply for a few credit cards quickly, which may damage your credit score.

What Are the Alternatives to Co-Branded Credit Cards?

Co-branded credit cards are only one of the options for those who are curious if they are right for them.

Travel credit cards are a good alternative if you travel frequently. There are various loyalty cards available that offer flexible points that can be transferred to partner airlines and hotel loyalty programs.

You can also use cashback rewards on credit cards with Best Cash Back Credit Cards. These rewards can be used for any expenditure, and there is no restriction regarding their use. Fees and charges can be paid off with the accrued cashback. These points can also be redeemed with the merchant partner.

FAQs

What Are The Eligibility Criteria For a Co-Branded Credit Card?

There are various criteria for eligibility for co-branded credit cards offered by different lenders. However, it would be best if you were between 18 and 65. In addition, you must already have a relationship with the lender.

What is The Difference Between a Store Credit Card and a Co-Branded Credit Card?

Most store credit cards are only valid at that store or chain of stores, and any rewards or benefits you earn are exclusive to that brand. Co-branded credit cards may offer rewards and benefits beyond their associated company or brand and can be used anywhere credit cards are accepted.

Are Co-Branded Cards Easier to Get Approved for?

The answer is no. The approval process for co-branded credit cards may be easier sometimes, but more is needed. Credit history and credit score are considered by the issuer when you apply for regular credit cards or co-branded credit cards. Make sure you know the requirements for the card you are applying for ahead of time, as each issuer has its application requirements.

Do Co-Branded Cards Offer Any Special Benefits?

There is a wide range of special rewards and benefits associated with co-branded credit cards. There are several ways to benefit from these programs, including cash back, higher earning rates, discounts on purchases, loyalty status, and other exclusive perks. There are also travel insurance and elite status benefits offered by co-branded travel cards, as well as concierge services and airport lounge access.

Add Comment