Are you looking for Rewards Credit Cards? f Yes, You are at the right place.

In this article, We are sharing all the information about Best Rewards Credit Cards.

Most people choose credit cards for their cashback benefits, but some credit cards with great reward points also need proper attention. Based on our research of various cards offered by different companies, we have selected those with reward points that can easily be redeemed since multiple users find redeeming reward points challenging.

Several types of credit cards are available, including those designed for students and small-business owners, as well as those designed for specific purposes, like building credit or repaying debt (Read: How to Negotiate Credit Card Debt?). Another type of credit card is a rewards card, which offers some form of bonus in exchange for spending with the card. Rewards cards are available for students, small business owners, and other credit card types, but not all are designed for them.

A rewards credit card can offer you a variety of rewards and rewards structures, potentially offering you a considerable amount of value. Credit cards with rewards are typically designed for certain spending, such as everyday purchases or travel.

A rewards credit card that suits you will depend on your spending habits, the rewards program and overall card structure. You may miss out on earning rewards and getting maximum value if your chosen card doesn’t fit your spending habits or lifestyle.

What are Rewards Credit Cards?

Contents

- 1 What are Rewards Credit Cards?

- 2 What are Credit Card Rewards?

- 3 How Do Rewards Credit Cards Work?

- 4 What Are the Different Types of Rewards Credit Cards?

- 5 Top 6 Best Rewards Credit Cards?

- 6 What are the Eligibility Criteria for Rewards Credit Cards?

- 7 How Do You Apply for Rewards Credit Cards?

- 8 Pros and Cons of Rewards Credit Cards

- 9 How to Get the Most Out of Your Credit Card Rewards?

- 10 How to Maximize Your Rewards?

- 11 Is a Rewards Credit Card Right for You?

- 12 How We Picked These Cards?

- 13 FAQs

A rewards credit card offers you a reward for your purchases, such as points, cash back, or miles. The rewards you earn can then be converted to statement credits to lower your credit account balance or to direct deposits to increase your bank account balance.

Depending on their terms, travel rewards or future purchases can also be redeemed with some cards. The value of points can vary depending on how they are redeemed, so they have more valuable redemption options than cash back.

The primary use of a rewards card is to return a portion of your regular spending. Select a rewards card with or without an annual fee to choose the one that best fits your budget.

What are Credit Card Rewards?

The rewards credit cards offer are cash back, points, or miles. On top of that, you can also earn a higher rewards rate on purchases in select categories if you choose to earn rewards on all purchases. There are several categories, including travel, dining, and groceries.

Credit cards with higher reward rates in certain categories typically offer fixed or rotating categories, which change every month or quarter. You’re also likelier to earn a lower reward rate on rotating categories after reaching the monthly, quarterly, or annual spending cap. It is also possible to find rewards credit cards with spending limits that do not have fixed categories.

A credit card may also allow you to earn rewards in other ways besides earning rewards on eligible spending. The welcome bonus offered to new cardholders is typically earned for spending a certain amount on the card within a certain period. A limited-time offer or referral bonus can also allow you to earn more rewards.

How Do Rewards Credit Cards Work?

Every time you use your cards to make a purchase, you are entitled to a reward. The rewards program of the card and the type of purchase you made will determine the rewards you receive.

There may be several redemption options available depending on the card. The redemption process varies by card since some require a certain amount of cash back, points, or miles before you can redeem.

Therefore, you must choose the card most appropriate for your spending habits and other preferences. Utilize the card and your goals of avoiding overspending and paying your bills on time each month to ensure you save money.

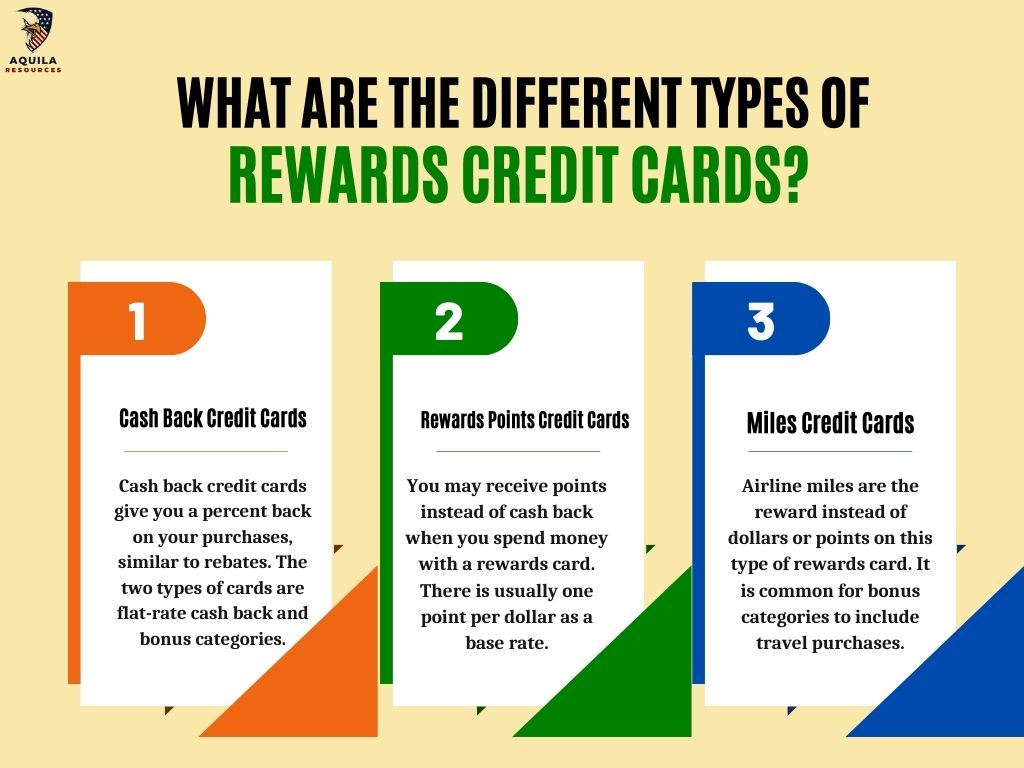

What Are the Different Types of Rewards Credit Cards?

There are three types of rewards credit cards for consumers: cash back, points, and miles. There are rewards cards designed specifically for business spending and rewards cards designed for consumers.

Cash Back Credit Cards

Cash back credit cards give you a percent back on your purchases, similar to rebates. The two types of cards are flat-rate cash back and bonus categories. A flat-rate card earns the same amount of cashback regardless of what you purchase. Some bonus categories are fixed or rotated, allowing you to earn more money back on certain purchases.

Cardholders are usually required to activate rotating bonus categories since the categories usually change every quarter. Different cash-back rates are depending on what you choose. The bonus categories on some cards could consist of gas stations, grocery stores, and restaurant spending.

Rewards Points Credit Cards

You may receive points instead of cash back when you spend money with a rewards card. There is usually one point per dollar as a base rate. Several factors affect point values, including the issuer, the purchase, and how the points are redeemed.

There are various ways to redeem points, including cash back, travel, and merchandise, with travel often delivering the greatest value.

Miles Credit Cards

Airline miles are the reward instead of dollars or points on this type of rewards card. It is common for bonus categories to include travel purchases. The amount of miles you receive depends on what you spend. For example, you might get 3 miles per dollar on airline tickets and 1 mile on everything else.

Travel credit cards earn miles and points you can apply toward many travel purchases, unlike co-branded airline cards that can only be used with partner airlines.

Small businesses can earn miles, points, or cash-back rewards when they spend money on a business credit cards rewards. You can earn rewards on these cards either flat-rate or in bonus categories, such as office supplies or telecommunications.

Top 6 Best Rewards Credit Cards?

The use of credit cards makes purchasing easier. You can also earn points, earn cashback, and save money with their rewards. The variety of rewards cards available can make choosing the right one challenging.

Here are the 6 Best Rewards Credit Cards –

Wells Fargo Active Cash Card

Wells Fargo Active Cash Card lets you earn rewards without worrying about rotating categories, activating rewards categories or determining the most rewarding bonus category. There is no annual fee; cash rewards are 2% on purchases. The card offers a 1% blanket cash rewards rate, so you’re in good shape.

The card offers a $200 cash rewards introductory bonus if you spend $500 on purchases within the first three months of account opening. In addition to the 0% introductory APR, purchases and qualifying balance transfers will be charged a variable APR between 20.24%, 25.24%, or 29.99% from the account opening date.

Pros & Cons of Wells Fargo Active Cash Card

Pros:

- Every spending category earns 2% cash rewards

- A $200 welcome bonus is available

- Purchases and balance transfers with 0% intro APR for 15 months

Cons:

- It charges a fee of 3% on foreign transactions

- J.D. Power gives Wells Fargo an average customer satisfaction rating.

Chase Sapphire Preferred Card

With the Chase Sapphire Preferred Card, you get the best rewards program of all travel cards at the $95 price point, especially if you redeem your points through Chase Ultimate Rewards. With Chase Ultimate Rewards, you can book hotels, flights, car rentals, experiences, and more on the company’s online platform. Your points will be boosted by 25% when you redeem them through this portal. The value of your points would be 1.25 cents instead of 1 cent if you redeemed them for statement credits.

With Chase Ultimate Rewards, you can earn 6.25% (5x points for travel booked through Chase), 3.75% for dining (3x points for dining), and at least 1.25 percent for other purchases (at least 1x points for other purchases), when redeeming for travel through the platform. Additionally, you’ll get travel insurance coverage and a welcome bonus while travelling.

Pros & Cons of Chase Sapphire Preferred Card

Pros

- Offers a big sign-up bonus

- Rewards for travel

- Rewards for dining

- Travel points with flexibility

- Travel and consumer protections

Cons

- The annual fee is

- A limited-time offer

American Express Gold Card

The Amex Gold Card is the ideal travel companion for cooks and restaurant lovers. However, due to the high annual fee of $250, this card should only be considered by people who can fully maximize its benefits.

The Gold Card does offer a sizable welcome offer and a few annual statement credits, which may help offset the annual fee.

The value of Amex Membership Rewards points depends on how they’re redeemed, though it offers a good reward rate. The value of your points can be redeemed for statement credits or flights through American Express Travel at 0.6 cents each.

Pros & Cons of American Express Gold Card

Pros

- The welcome offer is impressive

- Getting rewards at restaurants

- Supermarket rewards in the U.S.

- Credits for travel and dining

- The value of reward points is high

Cons

- An annual fee is required.

- Credits for inflexible spending

Blue Cash Everyday Card from American Express

The Blue Cash Everyday Card from American Express offers exceptionally high cashback rates across several major spending categories, especially for a card with no annual fee. This card has no annual fee and offers 3% cash back on groceries at U.S. supermarkets, clothes shopping at U.S. online retailers, and gas at U.S. gas stations.

The cashback is received as Reward Dollars, which can be redeemed for statement credits. You can also save money on interest charges with this card’s introductory APR on purchases, balance transfers, and rewards.

Pros & Cons of Blue Cash Everyday Card from American Express

Pros

- Cash back at U.S. supermarkets is 3%.

- There is no annual fee.

Cons

- Those with large grocery budgets may not qualify for the U.S. supermarket bonus category due to its spending cap of $6,000.

Citi Premier Card

The Citi Premier is an excellent travel card, offering various airline partners and excellent earning rates. The card awards the same points at gas stations, restaurants, supermarkets, airlines, and hotels, making it a great choice for beginners.

This $95 annual fee card offers rewards on several popular spending categories and boosted rewards for points earned. The points you earn at gas stations, restaurants, supermarkets, air travel and other hotels are multiplied by three, and you get one point for every dollar spent on all other purchases.

You will also earn 10 ThankYou points for booking hotels, car rentals and attractions (excluding air travel) through the Citi TravelSM portal for a limited time. Thanks Rewards points can be redeemed for a statement credit worth $0.01 each. If properly redeemed, you can earn 3% back at gas stations.

When redeeming these rewards, however, you should be careful since there are other ways to redeem them that could result in a lesser return.

Pros & Cons of Citi Premier Card

Pros

- You can earn 10 points per $1 spent on hotels, car rentals, and attractions, excluding air travel, through June 30, 2024, when you book through the Citi Travel portal.

- You earn 3 points per dollar on restaurants, supermarkets, gas stations, travel, and other hotels.

- Savings of $100 on hotels booked through thankyou.com for stays over $500, excluding taxes and fees.

Cons

- The annual fee is $95

- The card does not offer the same travel protections as other travel rewards cards.

Capital One Venture Rewards Credit Card

Capital One Venture Rewards Credit Card offers simplicity and strong rewards, which makes it the perfect choice for most travellers. There are no bonus categories to memorize, making this an ideal card for those who are always on the go. It earns 2x miles on every purchase.

Capital One Venture Rewards Credit Card allows travellers to earn 2x miles per dollar on purchases for an annual fee of $95. Capital One’s travel partners allow you to redeem your miles for past travel expenses or fund airfares partially. The credit card issuer, however, has few partnerships with U.S. airlines.

This card offers several good travel perks in addition to its rewards rate and welcome bonus, including an application fee credit for Global Entry or TSA PreCheck, primary insurance for auto rentals and travel accident coverage. The Venture Rewards credit card is a great option for travellers.

Pros & Cons of Capital One Venture Rewards Credit Card

Pros

- The sign-up bonus is excellent.

- Miles on purchases are unlimited.

- The travel credit

- A variety of ways to use miles

- There is no foreign transaction fee.

Cons

- An annual fee is required.

- There is no 0% intro APR offer.

What are the Eligibility Criteria for Rewards Credit Cards?

The eligibility criteria for rewards credit cards may vary, but they often include minimum age (18 or 21), income, good credit score, and responsible credit usage. Some may also require a particular occupation, so check before applying.

How Do You Apply for Rewards Credit Cards?

You can apply for a rewards credit card once you have considered all your options. The process above is a lot simpler and takes only a few minutes, thanks to the internet.

Here’s how You can Apply for Rewards Credit Cards–

- Ensure you read everything about the cards you’re considering, including their additional features and fees.

- Make sure you compare before applying. You need to have more than one option that seems suitable to you. Compare credit cards based on their fees, features, and rewards before applying.

- Please fill in the details carefully. There are a lot of details you need to provide in the rewards credit card application form. Fill out the form with information about yourself, your career, and your finances.

- Ensure that documentation is readily available. A credit card application will require you to provide a couple of documents, such as proof of identity, income proof, etc. You can use this information to help issuers assess your creditworthiness and profile.

Pros and Cons of Rewards Credit Cards

Rewards cards can save you money on purchases but also have downsides. Consider these pros and cons when shopping for your next rewards credit card if you’re wondering whether rewards credit cards are worth it:

Pros of Rewards Credit Cards

| Pros | Details |

| Rewards | How you spend can earn rewards that you can use to save money. |

| Sign-up Bonuses/Introductory APRs | To earn extra rewards or assist in paying down a large purchase, you can use a generous sign-up bonus or intro APR. |

| Perks | Some cards provide additional perks, such as access to airport lounges, hotel upgrades, and protection against travel or shopping fraud. |

Cons of Rewards Credit Cards

| Cons | Details |

| Rewards Caps | Cards with a limit on points or miles can reduce the card’s value if you spend a lot more than the cap allows. |

| Higher APRs | Overdraft charges and balance transfers can result in higher APRs cancelling rewards. |

| Higher Annual Fees | The annual fee on some cards may only be worth the value of the perks provided if you maximize your rewards earnings. |

How to Get the Most Out of Your Credit Card Rewards?

Using your card to earn points on everyday purchases is the best way to maximize your rewards, and redeeming those rewards is the best way to maximize your per-point earnings. Transferring rewards into loyalty programs or redeeming past travel expenses for travel credit cards could offer the highest redemption value.

The points you transfer from Chase Ultimate Rewards to Hyatt’s World of Hyatt program will go much further than if you redeem them for the same Hyatt room on Chase’s site.

The best way to redeem your rewards will depend on your credit card terms, and you will also need to make sure you pay your bills on time and in full to avoid incurring interest charges. You can earn 5% rewards with some cashback rewards cards, but they usually have spending limits before rewards fall to 1%. An example of a higher reward category would be gas stations in one quarter and grocery stores in another.

How to Maximize Your Rewards?

The process of developing a comprehensive credit card strategy takes time. You can maximize your rewards by following these steps:

- Spend and Redeem Rewards Intelligently: Spend your money on categories that earn the highest rewards. Tracking your spending will reveal areas where you can earn rewards. After redeeming your rewards, make sure they are worth the maximum amount.

- Get Your Sign-Up Bonus: Plan your spending so you can spend your money wisely and redeem your bonus through the best method (e.g., transfer partner, issuer travel portal, etc.).

- Utilize Your Extra Benefits: Consider offsets such as rewards earned from normal spending to offset your annual fee. Make the most of your card’s annual credits and benefits to get more value without relying on rewards to offset the annual fee. A no-annual-fee card may be better if you need help paying the annual fee or a premium card if you spend a lot.

- Make Your Credit Cards Work for You: Combining your credit cards can earn even more rewards. A credit card that earns rewards in your highest spending category should be combined with a flat-rate credit card that provides a helping hand. If you do this, you will earn rewards on every key purchase, regardless of whether it falls within the usual credit card bonus categories.

- Understanding Merchant Category Codes: You can determine what bonus categories your card is eligible for by looking at these four-digit codes. Your card network’s MCCs can help you determine whether your shopping habits need to be changed, which card is best for certain expenses and what rewards you might earn.

- Avoid Carrying a Balance: If you carry a balance, you’ll accrue interest charges, quickly eating up any rewards you earn.

- Change Your Rewards Strategy as Your Spending Shifts: It may be necessary to adapt your credit card strategy according to your changing lifestyle. The benefits of credit cards can help minimize inflation costs, such as those associated with groceries, gas, dining out, and other major expenses. If you plan on commuting again, you may be better off with a credit card that rewards gas purchases, travel or public transportation.

Is a Rewards Credit Card Right for You?

Credit cards that offer rewards can be a great way to earn rewards on your spending. When you swipe your credit card without reward points, you could be losing out on cash back or travel rewards. Travel rewards credit cards can also be an excellent way to save time and money if you travel frequently. Consider what you’ll do with reward points, such as using them for a specific vacation. It will then be possible for you to determine the type of points you’ll need.

You must select a rewards card that will maximize reward points on your everyday essential purchases, not one that will change your spending habits or make you buy things you don’t need or can’t afford. Charges and interest charges can wipe out rewards quickly if you carry a balance or miss payments.

How We Picked These Cards?

We analyzed various factors to determine which rewards credit cards are the best. We first looked for cards that offered the best cash back, points, or miles opportunities. A second consideration was that most rewards credit cards require good or excellent credit, making building a credit history difficult. We added a couple of options for people with less-than-stellar credit.

Lastly, we also incorporated a mix of cash-back cards, travel rewards cards, and general points cards, including some with or without annual fees, so you can choose one that matches your needs.

FAQs

How Does a Rewards Credit Card Work?

You can earn rewards from rewards credit cards through cashback, points, or miles on your purchases. When you make an eligible purchase, your rewards balance will be added to your credit card account, and you can then redeem your rewards.

Do Credit Card Rewards Expire?

There are times when credit card rewards expire, whether after a certain period has passed since earning the points, after inactivity on the account, or when you close the account. By reading your card’s terms and conditions, you can determine if yours will.

What Credit Score Do I Need to Get a Rewards Credit Card?

A good to excellent credit score is typically required to qualify for the best rewards credit cards. Credit scores of 690 or higher are generally good. The good news is that you can get some good rewards-bearing cards even if you have fair or bad credit.

Add Comment