Are you looking for Online Installment Loans for $5000 for Bad Credit? If Yes, You are at the right place.

In this article, We are sharing all the information about Online Installment Loans of $5,000 with Bad Credit.

If you’re facing financial hurdles with a less-than-ideal credit score and need a $5,000 loan, exploring online installment loans for bad credit might be helpful. Based on my experience, these loans can be a practical choice for those who find traditional lending options inaccessible. Applying for an online installment loan was quick and easy, even with my credit challenges.

The application was entirely online, requiring some basic personal and financial details. The approval was faster than I anticipated, which was a relief given my urgent need for funds. The loan terms, including interest rates and repayment schedule, were clear and manageable.

This experience helped me address my immediate financial needs and provided a structured way to improve my credit score. For anyone in a similar situation, considering online installment loans for $5,000 for bad credit could be a beneficial step toward financial stability.

What Are Online Installment Loans for Bad Credit?

Contents

- 1 What Are Online Installment Loans for Bad Credit?

- 2 Where to Get an Online Installment Loans for $5000 for Bad Credit?

- 3 List of Guaranteed Installment Loans for Bad Credit Direct Lenders Only

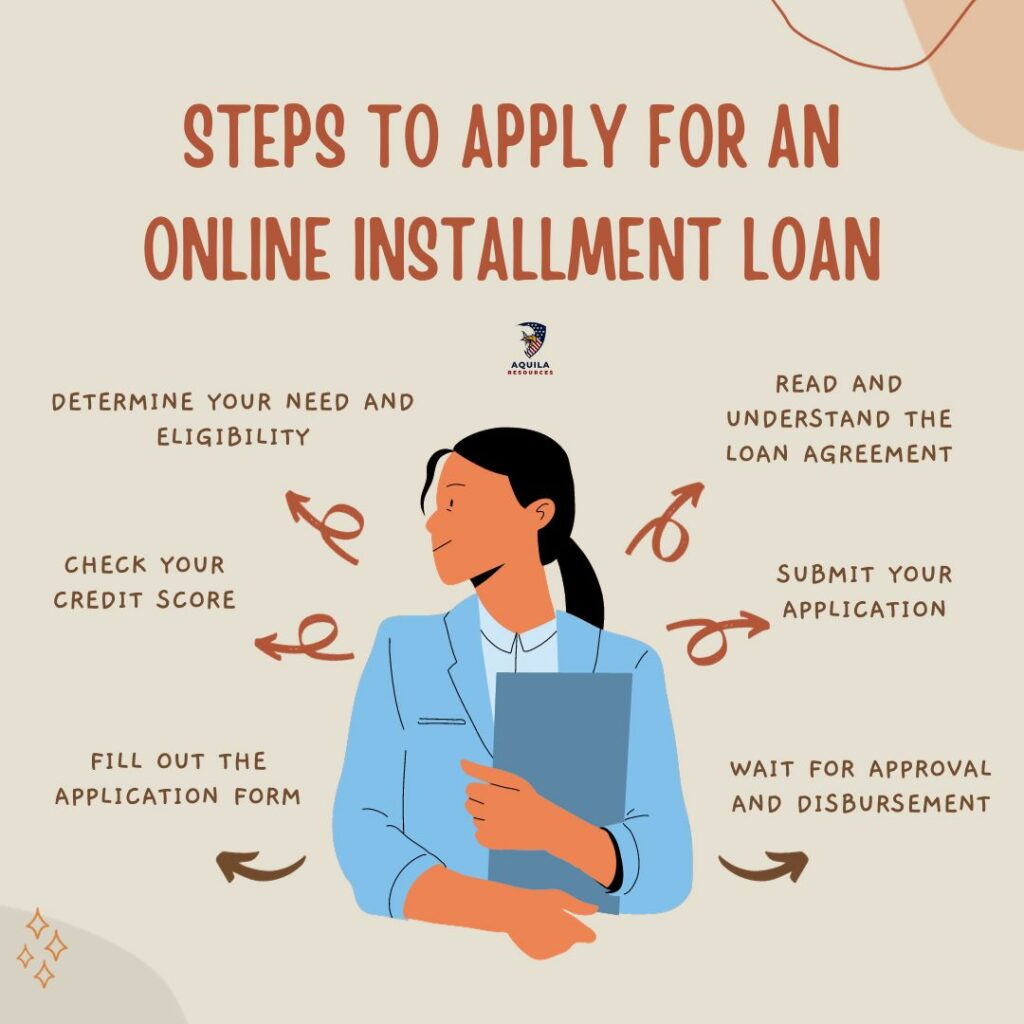

- 4 Steps to Apply for an Online Installment Loan

- 5 Tips for Choosing the Right Loan and Lender

- 6 FAQs

With an online installment loan, you receive an upfront cash amount that must be repaid in equal monthly installments, making them an excellent option for people with bad credit. These loans have terms that can range from three months to seven years.

There are two types of installment loans online for bad credit: secured and unsecured:

- A secured installment loan requires collateral, such as a vehicle or house, that the lender can claim if a loan defaults.

- Since unsecured installment loans don’t require collateral, they have higher interest rates and are riskier for lenders.

A bad credit loan usually has a fixed interest rate, predetermined principal amount, and interest payment. The installment you’re supposed to pay remains the same throughout the tenure of the loan.

The following is a quick overview of the main characteristics of bad credit personal installment loans:

- A fixed monthly payment lasting between 24 and 84 months.

- Rates and terms of the loan are predetermined.

- Disbursement of a lump sum upfront.

- Collateral is not required for unsecured loans.

- Any purpose can be met with loan funds.

An installment loan for bad credit provides a more predictable arrangement than credit cards and lines with fluctuating rates, making budgeting easier.

With this type of loan, you can access bigger lump sum amounts than you would normally be able to with a credit card. However, you will likely pay higher interest rates without collateral, especially if you have bad credit.

Where to Get an Online Installment Loans for $5000 for Bad Credit?

Each institution offers different products, eligibility criteria, and terms for installment loans. Installment loans can be obtained through a bank, credit union, or an online lender. It’s important to understand the available types and their pros and cons. Here’s an overview:

Peer-to-Peer Lending (P2P)

P2P lending platforms like Prosper or LendingClub connect borrowers directly with individual investors. Loans on these platforms can be more flexible in terms of approval criteria.

- Pros: Often lower interest rates than traditional banks; more lenient credit requirements.

- Cons: Loan amounts might be limited and require a credit check.

Traditional Banks

Traditional banks offer personal installment loans with fixed interest rates and repayment terms.

- Pros: Potential for higher loan amounts; established reputation and customer service.

- Cons: Typically stricter credit requirements; longer processing times.

Online Lenders

Online lenders specialize in personal loans and often cater to individuals with bad credit. They offer a streamlined online application and approval process.

- Pros: Quick application and approval process; flexible lending criteria; convenient and accessible.

- Cons: Higher interest rates for bad credit; potential for hidden fees.

A bank is more accessible than a credit union because you do not have to be a member to access loan products. If you’re already a member or customer, the bank may offer exclusive benefits to existing customers, such as rate discounts or extended repayment terms. However, they tend to have stricter lending criteria.

Credit unions and online lenders have lower overhead costs; thus, they may offer better rates. Online lenders also offer a faster approval process, rapid approvals, and faster funding times since everything is automated.

You’re less likely to have the luxury of visiting a branch and speaking face-to-face with a loan officer with an online lender than with a bank or credit union because only some online lenders have brick-and-mortar locations.

With the help of most lenders, you can apply for a wide range of products online, from auto loans to mortgages to six-figure personal loans. In contrast to car loans and mortgages, which require a more thorough review of your credit history and score, personal loans are typically approved within a few days.

Whenever you need a loan, compare rates from at least three lenders to see the best rate for your situation. Prequalification is a tool that enables borrowers to determine their predicted interest rates and approval odds before applying without affecting their credit score. Many online lenders make this process easy by offering it.

List of Guaranteed Installment Loans for Bad Credit Direct Lenders Only

We’ve compiled user-friendly Guaranteed Installment Loans for Bad Credit Direct Lenders Only to help you find reliable solutions tailored to your needs without the hassle of stringent credit checks. Check out the list below:

GreenDayOnline

The Best Installment Loans Online for Those with Bad Credit Who Need $5,000 No Credit Check Loans.

GreenDayOnline is a financial service provider offering various loans, primarily focusing on individuals with bad credit. Their offerings include bad credit installment, payday, title, and emergency loans. Applicants must provide personal and financial information such as Social Security number, email address, checking account details, and proof of income. The application process is conducted online, and the loans can be used for various purposes, including auto repairs, medical bills, debt consolidation, or home improvements.

GreenDayOnline’s bad credit installment loans are repaid in regular, monthly payments, similar to mortgages. This option suits those needing to spread out their repayment over time. They also offer title loans, using a car’s equity as collateral. Payday loans provided are short-term with high-interest rates and are advised for temporary financial needs.

However, GreenDayOnline emphasizes that their services are not a long-term financial solution. Consumers with credit issues or debt are encouraged to seek professional financial advice. Additionally, their services are only available in some states, and users are urged to understand the terms and conditions of any loan agreement before proceeding.

Eligibility to Qualify for a Loan of $5000 with GreenDayOnline

To qualify for a $5,000 loan with GreenDayOnline, especially if you have bad credit, there are several criteria and details you need to consider:

- The minimum age requirement is 18 years of age and United States citizenship or permanent residency.

- At least 90 days must have passed since you worked somewhere.

- A monthly cash flow of $1,000 should be maintained after taxes.

- Your bank account must be active.

- You must have a working email address and home and work phone numbers.

PaydayChampion

PaydayChampion is recognized as a leading online provider of payday loans in the United States. They offer a variety of loan types, including payday loans, installment loans, and title loans. The company operates from Houston, Texas, and provides its services nationwide.

PaydayChampion is known for its convenient online application process, catering to those needing quick financial solutions, especially in emergencies. Their services are tailored to meet the needs of individuals seeking short-term financial assistance. Lenders must check your credit to offer monthly loans up to $5000.

Eligibility for Payday Champion Loan Requests of $5000

A minimal credit score is fine if you seek an installment loan online through PaydayChampion. However, you must meet the following three criteria to qualify for the loan:

- The minimum age for participation is 18 years old.

- The applicant’s Social Security number must be used as proof of citizenship or legal status.

- Whether you work full-time, are self-employed, or receive government benefits, you must have a steady source of income.

It is confidently possible for you to submit a loan application to PaydayChampion if you meet these standards.

RixLoans

RixLoans offers payday, installment, and title loans, catering to individuals with bad credit. They provide a secure platform connecting borrowers with licensed lenders. While their loans, especially for bad credit, may have higher interest rates and could be for smaller amounts, they are accessible online, offering a convenient and speedy application process. However, these loans might only be available in some states and could have additional fees like origination fees. It’s important to consider your ability to repay before applying.

Lenders cannot guarantee approval for cash advance loans, including those for bad credit, and borrowers must meet certain conditions to qualify.

Eligibility to Qualify for RixLoans

The specific eligibility criteria to qualify for a loan from RixLoans are not available. However, typical requirements for such loans generally include:

- Age Requirement: You must be at least 18 years old.

- Residency: Legal residency in the United States is often required.

- Income: A verifiable source of income, such as employment.

- Bank Account: An active checking account is usually necessary.

- Contact Information: Valid phone number and email address.

You may only be able to qualify for a no-credit-check loan with your credit score impacting. However, some lenders still authorize bad credit and lesser installment loans online with guaranteed approval if they require a credit check. Read the lender’s terms and conditions to avoid unwarranted credit check requirements.

PaydayDaze

Want a quick and easy solution for short-term financing? PaydayDays is your only choice!

PaydayDaze Loans is an online lending platform offering personal installment loans ranging from $100 to $5,000, primarily to borrowers with low credit scores. The loans have fixed repayment terms, generally between 3 and 24 months. Their application process is quick and simple, with the possibility of next-business-day funding.

However, the loans come with high-interest rates and specific eligibility criteria that may exclude some borrowers. Customers have reported mixed experiences, with some praising quick access to funds and others citing high rates and customer service issues.

Eligibility for PaydayDaze’s Installment Loan Service

To qualify for an installment loan from PaydayDaze, you generally need to meet these criteria:

- Minimum Credit Score: Likely required, but specific score criteria might vary.

- Stable Income: Proof of a regular income source.

- Bank Account: An active checking account for fund deposit and repayment.

- Age and Residency: At least 18 years old and a legal U.S. resident.

- Valid ID and Contact Info: Government-issued ID and contact details like phone and email.

For precise eligibility requirements and application details, it’s best to contact PaydayDaze directly.

GadCapital

GadCapital offers online short-term loans, including payday, title, installment loans, and merchant cash advances. They also provide loan consolidation services, helping borrowers manage multiple payday loans. The application process is online, and approval can be quick.

However, it’s important to be aware of potentially high interest rates and fees associated with these loans. Borrowers are encouraged to repay loans early. GadCapital’s services may vary by state, and they are a member of the Online Lenders Alliance, indicating adherence to ethical lending standards.

In general, several factors will determine the amount of loan you qualify for, including your financial situation and what kind of loan you want. You may receive a loan with no credit check and guaranteed approval, or you may have to undergo a full background check.

Eligibility Requirements of GadCapital

The eligibility requirements for obtaining a loan from GadCapital generally include the following:

- Age Requirement: Applicants must be at least 18 years old. The minimum age requirement for some loan types, such as installment loans, could be 25 years.

- Citizenship: Applicants need to be U.S. citizens.

- Steady Income: A steady monthly income is required. The minimum income requirement varies depending on the type of loan; for instance, payday loans require a minimum monthly income of $800, while installment loans require at least $1,300 per month.

- Bank Account: An active bank account allowing direct deposits is necessary.

- Additional Information: The application typically asks for personal information (such as name, phone number, address, and social security number), employment details (including income type employer information), and financial details (like bank name and account details).

- Military Status and Marital Status: These may also be considered during application.

- Credit Check: While not explicitly mentioned in the sources, many lenders, especially for installment loans and merchant cash advances, may conduct credit checks.

These criteria are fairly standard for short-term loan providers but can vary slightly based on the specific loan type and lender policies. It’s always advisable to read the specific terms and conditions on GadCapital’s website or contact them directly for the most accurate and up-to-date information.

Steps to Apply for an Online Installment Loan

Applying for an online installment loan, especially if you have bad credit, can seem daunting, but it’s straightforward when broken down into manageable steps. Here’s a guide to help you through it:

- Determine Your Need and Eligibility: Assess how much you need and verify if you meet the basic criteria (like age, income level, and citizenship status) for the loan.

- Check Your Credit Score: Understanding your credit score is important, as it influences the terms and availability of your loan.

- Research and Compare Lenders: Look at different lenders, like GreenDayOnline, PaydayChampion, RixLoans, PaydayDaze, and GadCapital. Compare their offers, interest rates, terms, and eligibility requirements.

- Prepare Necessary Documentation: Get your documents ready. Generally, lenders will require proof of identity, income, and bank account details.

- Fill Out the Application Form: This step is usually done online. Provide all the required information accurately to avoid delays.

- Read and Understand the Loan Agreement: Before accepting the loan, ensure you understand all the terms and conditions, including the repayment schedule, interest rates, and fees.

- Submit Your Application: After double-checking your information and documents, submit your application.

- Wait for Approval and Disbursement: If approved, the lender will outline the next steps to receive your funds. The disbursement time can vary depending on the lender.

- Plan for Repayment: Once you receive the funds, it’s important to adhere to the repayment schedule to avoid any additional fees and to help improve your credit score.

Thoroughly research and understand each lender’s specific requirements and processes. Each lender has unique processes and requirements, so the lender’s steps might vary slightly.

Tips for Choosing the Right Loan and Lender

Choosing the right personal loan depends entirely on how much you need to borrow and the type of loan you qualify for.

- The most important thing to remember is to narrow down your choices based on your eligibility and the factors that matter to you most. Interest rates, loan amounts, and fees all deserve consideration.

- Prequalify with each lender before comparing your options, as this will allow you to see the rates without damaging your credit.

- Review the lender’s terms if you wish to repay your loan early. One lender may have the lowest interest rate, but it could have a prepayment penalty, making it difficult to repay your loan early.

- When you apply, you will be asked to complete a detailed application to ensure you qualify. If you qualify, you must sign the final paperwork before your loan can be disbursed.

Don’t let origination fees or higher interest rates fool you into thinking that a lender isn’t worthwhile. Run the numbers before you apply for a loan. Lenders with a poor reputation or customer service could prove even more expensive if they offer a personal loan.

FAQs

How Does a Greendayonline Bad Credit Installment Loan Work?

As a rule, installment loans, such as mortgages, are repaid with regular, equal monthly installment payments.

In comparison to visiting a bank branch or credit union in person to apply for an installment loan, online installment loans are administered by specialist lender aggregators such as GreendayOnline.

What Makes Your Quick $100-$5000 Loans So Different?

Many people can get loans at GreendayOnline for varying amounts of money. Tell them how much money you’d like to borrow once approved for a loan amount.

Depending on your location, they can offer loans ranging from $500 to $5,000. Funds are typically available by the end of the next business day for applications processed before 5 p.m.

What Are the Steps to Apply for an Online Installment Loan?

Installment loans are usually easy to apply for. Applicants must provide proof of employment and a checking account and fill out a form.

Lenders will notify applicants in writing about loan approval or denial after they have completed their review. Installment loans can be approved as soon as the next day with GreendayOnline.

Can I Get Instant Loans With Guaranteed Approval, Even With Bad Credit?

Bad credit loan companies may claim to guarantee your approval. However, lenders cannot give all applicants a loan based on their credit score. The lender will weed out anyone who won’t repay the loan and must be able to collect on it.

Add Comment