What is your opinion on the practicality of a $1000 Installment Loan No Credit Check? A bad credit score is a hassle, especially if it is something you deal with on a daily basis. Now that Installment Loan No Credit Checks are widely available, people with bad credit can get the necessary funds.

If you are searching for a reliable loan platform connecting you with many lenders who offer a real Installment Loan No Credit Check, you have come to the right place.

We have vetted the best lenders for a $1000 Installment Loan No Credit Check and listed them below. This page provides you with all the information on the best $1000 Installment Loan No Credit Check.

Let’s get started.

What is An Installment Loan?

Contents

- 1 What is An Installment Loan?

- 2 How Does An Installment Loan Work?

- 3 Types of Installment Loan No Credit Check

- 4 Where To Get An Installment Loan No Credit Check

- 5 Top $1000 Installment Loan No Credit Check

- 6 How To Find An Installment Loan No Credit Check

- 7 How To Get A Quick Installment Loan No Credit Check

- 8 How To Qualify And Apply For Installment Loan No Credit Check?

- 9 How To Compare Installment Loan No Credit Check?

- 10 Alternatives of Installment Loan No Credit Check

- 11 What is The Credit Check Process For Installment Loan No Credit Check?

- 12 FAQs

- 13 Conclusion

An installment loan term represents a set amount of time over which you will pay off your debt. When you pay down an installment credit balance, it can’t be reused like credit cards or lines of credit. Personal loans must be applied for if you wish to borrow more money with an installment loan.

How Does An Installment Loan Work?

Borrowers can take out installment loans for predetermined amounts, paid in a lump sum, and repaid over 30 years. Regular monthly payments are typically required for these loans, which usually come with fixed interest rates.

A portion of each monthly payment goes toward the principal amount borrowed, and another portion goes toward interest. The lender will close your account once the principal and interest on the loan have been paid in full. You will continue to make payments over the loan term.

Types of Installment Loan No Credit Check

There are many types of Installment Loan No Credit Check. The features, loan purposes, and average interest rates of each type differ despite the fact that they operate similarly.

A Personal Loan

A personal loan is an unsecured installment loan with a fixed interest rate and monthly installment payments. It is repaid in installments over a fixed period. Some lenders offer terms up to 72 months, while others offer as low as 24 months. These loans are available through online lenders, private lenders, and credit unions.

Generally, loans range from $1,000 to $100,000, are provided in a lump sum, and can be used for various purposes. However, some lenders limit the use of loans for school costs or gambling.

A Mortgage

There is also the option of taking out a mortgage as a secured Installment Loan No Credit Check. A fixed-interest rate mortgage is most commonly used by homeowners who may borrow money and pay it back over 15 or 30 years. A mortgage loan can be worth over $1 million in some cases in expensive neighborhoods throughout the country, making them much more expensive than personal loans. An interest rate on a mortgage tends to be lower since a home backs it.

The mortgage process can take up to 60 days to complete. The lender determines whether you are capable of repaying the loan based on your income, job stability, credit history, down payment savings, total debt, and the type of home you are buying.

Auto Loans

A secured installment loan can also be secured by a car. A consumer typically makes a down payment or trades in their existing vehicle and then finances the purchase price balance with a car loan. Monthly payments are used to repay the Guaranteed Approval Auto Loans to the lender.

You can complete the process fairly quickly if you buy a new car from a dealership or an online lender. It may take longer when you finance a used car from a bank or credit union and purchase it from a private party.

A Student’s Loan

In general, student loans fall into two categories: private and federal. Both Installment Loan No Credit Check must cover college tuition and expenses related to college attendance.

Federal student loans are generally available to all students who qualify. A federal student loan does not require a minimum credit score, and no credit check is involved unless you are taking out a Direct PLUS loan for parents, graduate students, or professionals.

Buy Now, Pay Later Loans

You can make a purchase and pay for it in interest-free installment payments with buy now, pay later loans. There is a specific payment period, usually a few weeks,

Because BNPL loans encourage you to spend more than you can afford, you may end up overspending. A loan of this type can also lead to the illusion that products or purchases are less expensive than they are.

Payday Loans

A payday loan is an Installment Loan No Credit Check secured by your paycheck, which means no credit check is required. When consumers do not qualify for other forms of credit or have an emergency, payday loans can help them. Although payday loans are often categorized as predatory, they help consumers during emergencies. There is generally a $500 maximum amount limit, which is lower than a personal loan. While interest rates are higher than traditional loans, they are generally unaffordable for most people. Borrowers can become trapped in a debt cycle due to payday loans short-term, high-cost nature.

Payday loans are obtained by submitting a postdated check along with any fees. You provide the lender with the check; they hold it and give you cash until your next payday when the lender cashes it.

Where To Get An Installment Loan No Credit Check

The following are a few of the most common ways to get an Installment Loan No Credit Check:

The Banks

It is important to remember that banks are for-profit businesses that compete to offer the lowest rate, giving you the benefit of low rates. The costs of these loans are generally higher than those of other lenders.

The Credit Union

It is a not-for-profit financial institution where you can become a member. The benefits and rates are usually better for members, but membership requirements are usually present.

Online Lenders

The services and products offered by online lenders are similar to those of banks, but they do not have brick-and-mortar locations. The rates on their loans tend to be more affordable, and the rates on their savings accounts tend to be higher.

Markets Online

Companies that operate as go-betweens between you and lenders offer online platforms that allow you to compare multiple offers from various lenders simultaneously.

Top $1000 Installment Loan No Credit Check

OppLoans

An OppLoan is a high-cost, short-term loan available in most states. Creditworthiness and ability to repay are not factors used to determine whether loans have triple-digit annual percentage rates.

As part of the OppLoans application process, the Opp fintech platform reviews applicants’ bank account transactions to assess their monthly cash flow. People whose credit scores make them unqualified for other loans can apply for OppLoans’ short-term, payday-loan-like loans. OppLoans charges rates in the same inflated range as most payday loan lenders. OppLoans does not conduct a hard credit check or disqualify individuals based on credit scores. However, your credit report won’t be affected by a soft credit check.

OppLoans Benefits

- There are no prepayment fees

- APR fixed at 160%

- Repayment terms of 9-18 months*

- Applications submitted and approved by 12:00 PM CT can be funded the same day, Monday through Friday.

- All three credit bureaus are notified of payment history

- An easy application and a quick decision!

- Depending on creditworthiness and location, you could receive $500 to $4,000

- FICO ® credit scores are not affected by applying

Opp Loans Qualifications

- You must be at least 18 years old.

- An income that is regularly deposited into a bank account is required.

- The service is unavailable in Alabama, Colorado, Connecticut, Georgia, Iowa, Maryland, Massachusetts, Nevada, New York, Pennsylvania, South Dakota, West Virginia, or Washington, DC.

OppLoans Pros and Cons

| Pros | Cons |

| No origination fee | Not available in all states |

| Funding on the same day | Potential for predatory rates |

| Reports to major credit bureaus |

Integra Credit

Consumers with bad credit can get credit from Integra Credit. There are different APRs, terms, amounts, and fees depending on where you live. People with less-than-perfect credit can apply for an Installment Loan No Credit Check through Integra Credit. It offers loans in the range of $500 to $3,000 for a term of 10 to 24 months (loan terms vary by state). Online applications for Integra should be approved quickly.

The online installment loans provided by Integra Credit help you access the cash you need while offering the flexibility you need. Integra Credit disrupts the online subprime lending market by offering flexible installment and open-end credit products with a proven team with over 30 years of experience in the industry. The company offers millions of consumers in need of small-dollar, affordable loans with its cutting-edge consumer lending platform. It only takes a few minutes to complete the Integra Credit application online.

Integra Credit Benefits

- The APR starts at 99%.

- Funds can be accessed quickly. Depending on the approval process, you may be able to receive your money within one business day*.

- There is no origination fee.

- A short loan term.

Integra Credit Qualifications

- A minimum age of 18 is required

- Citizenship or permanent residency in the U.S.

- Social Security Number

- Account number

- If you reside in the following states: Alaska, Colorado, Connecticut, District of Columbia, Georgia, Hawaii, Illinois, Iowa, Maine, Maryland, Massachusetts, Nevada, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Oklahoma, Pennsylvania, Rhode Island, Vermont, Virginia, Washington, West Virginia, Wyoming.

Integra Credit Pros and Cons

| Pros | Cons |

| Timeline for funding | Extremely high APRs |

| No penalties for prepayment | Terms of repayment are short |

| Small loan amounts available | Availability varies by region |

Upstart

The Upstart platform connects borrowers with over 100 potential lenders, including banks and credit unions. By leveraging artificial intelligence, Upstart examines jobs, education, and where you live instead of relying on credit scores as a qualification factor. Borrowers who are rejected by more traditional lenders or who receive high-interest rates generally benefit from this model. In addition, Upstart offers lower rates than many of the best lenders, even though it caters to borrowers with bad credit or no credit.

This company offers the Installment Loan No Credit Check for debt consolidation because it requires a credit score of 620+, offers loan amounts of $1,000 to $50,000, and has repayment periods ranging from 36 to 60 months.

In addition, Upstart has a user rating of 3.8/5, which is better than many other installment loan providers for people with bad credit. If you’re in need of same day installment loans with no credit check online, explore all options thoroughly.

Upstart Benefits

- A $1,000 loan is available

- Apply for and close loans that meet your prequalification

- A loan for borrowers with a FICO score over 300

- Your credit score is not affected by checking rates

- Credible powered by

Upstart Qualification

- Age 18 or older

- Earn at least $12,000 a year

- Most cases require a credit score of 300 or higher

- Washington, D.C., and all U.S. states are available.

- Must be U.S. citizens or permanent residents.

- Obtain a Social Security number, bank account, and email address.

Upstart Pros and Cons Table

| Pros | Cons |

| Funding the next day | Fees associated with origination are high |

| Credit requirements for open accounts | Customers are less satisfied |

| A single loan can be taken out multiple times | Co-borrowers or co-signers are not allowed to apply |

| Repayment terms are limited (only 3 and 5 years) | |

| Information may be shared with multiple lenders |

Upgrade

Upgrade offers loans with Terms ranging from 24 to 84 months, which is a wider range than the terms offered by many lenders. Some states have different minimum loan amounts, but most loan amounts range between $1,000 and $50,000.

Among its many offers are discounts and bonuses for autopay and upgrading checking accounts. As an additional benefit, Upgrade says customers can get a discount on their interest rate if they allow the lender to pay off their existing loan or credit card balance directly. The minimum credit score for approval is 620, which is not very high compared to other lenders with similar terms. As a result of their review, Upgrade received a score of 4.5/5 in the category Requirements & Application Information.

Upgrade Benefits

- A clear payoff date and fixed rates

- You can easily choose the loan amount and term that suits your budget and timeline by exploring multiple options

- Account management online or via mobile app: automatic payments and customizable due dates

- There are no penalties for prepayment

- Monitor your credit score, learn about credit, and get personalized recommendations to help you manage it

Upgrade Qualification

- A minimum age of 18 is required

- A score of at least 620 on your credit report

- A bank account and an email address are required

- The service is available in all 50 states and Washington, D.C.

- A valid visa is required for citizens, permanent residents, and non-permanent residents of the United States

Upgrade Pros And Cons

| Pros | Cons |

| No penalty for prepayment | Loan amount reduced by origination fee |

| Funds sent within one business day | Higher interest rates than competitors |

| Diverse repayment terms and loan amounts |

Possible Finance

An Installment Loan No Credit Check from Possible Finance can be as high as $500 for consumers with bad or no credit. The repayment terms range from eight to 12 weeks, and payments are made biweekly. According to consumer advocates, Possible’s rates can reach 248% in some states, which is extremely high when compared with the 36% maximum APR that most states recommend as an alternative to traditional payday loans. Possible markets itself as a low-cost, short-term loan alternative. The rates on Possible loans are lower than payday loans, but they are still high, and borrowers are required to make biweekly payments over eight weeks.

Lenders don’t perform hard credit checks on applicants, but they review their bank account transactions to determine eligibility and loan amounts.

Possible Finance Benefits

- Instantly unlock a $400 or $800 credit limit

- You can apply in minutes without a credit check or deposit

- Forever 0% interest

- There are never any late fees

- Monthly fee of $8 or $16

- Installment payment plan

Possible Finance Qualifications

- You will need a mobile or electronic device that can access the mobile or web app.

- A minimum age of 18 is required.

- You will need a valid driver’s license, identification card, or passport.

- An SSN.

- A monthly income of at least $750 is required.

- An insufficient funds fee or a minimum number of returned checks.

- Credit is available in a healthy amount.

- Using Plaid to connect your checking account with financial apps.

- A minimum of three months’ worth of transactions in your bank account, including recent deposits and a regularly positive balance.

Possible Finance Pros And Cons

| Pros | Cons |

| Fast funding | High interest rate |

| Accepts borrowers with thin credit histories or low credit scores | Customer service only available through online form |

| Loans difficult to assess before borrowing | |

| Short repayment terms |

How To Find An Installment Loan No Credit Check

If you search online for “Installment Loan No Credit Check,” you may find high-interest lenders promising fast approval and no credit check. These loans may be fast and easy to obtain, but their interest rates may be high.

You can find affordable installment loans near you by following these tips:

Consider A Bank

Installment loans may be available if you have a good credit history and have banked locally for some time. Borrowing requirements at banks tend to be tighter than at other lenders, but long-term customers might have an edge. Most major banks provide small loans to existing customers at low interest rates. Check with your bank to see if they have any options before borrowing elsewhere.

Find A Credit Union

A credit union is a not-for-profit organization that provides loans to its members. Some federal credit unions cap the APR on personal loans at 18%, and some offer payday alternatives with month-long repayment terms and rates capped at 28%. A credit union requires membership before you can borrow money.

Online Shopping

A mobile phone or computer can be used to apply for an Installment Loan No Credit Check; you do not need to live close to a bank or credit union to borrow money. You can often find predatory online lenders on the rates and terms page, so ask before applying for a loan or look for their rates and terms page. Affordability is typically not a secret for online lenders.

How To Get A Quick Installment Loan No Credit Check

Installment Loan No Credit Check are usually funded the same day, with quick application processes. You can get a loan quickly without a credit check if you follow these steps:

- Make sure you have proof of income. You may be approved for a no-credit-check loan based on your income, employment history, banking history, bank balance, and spending habits. You could be asked to provide pay stubs, tax documents, or bank activity to prove your creditworthiness.

- You can sign up for direct deposit. Certain lenders require a direct deposit account to qualify for loans.

- You will need to fill out a loan application. The process for a no-credit-check loan application varies from lender to lender, but most lenders accept applications online or through apps.

- Funding can be obtained. Once it has been approved, your loan may be deposited into your bank account in a few days or even the same day.

- You need to make payments. You will be informed when payments are due, and your bank account may be automatically debited.

How To Qualify And Apply For Installment Loan No Credit Check?

A stable income flow and a good credit history are needed for most lenders to approve a loan application. Loans vary depending on how lenders evaluate applications, so it’s a good idea to compare lenders before applying.

It will be easier for you to determine which installment loan lender is right for you if you learn what lenders look for, such as your credit score and income. You can determine your loan qualifications as you go through the application process by following this strategy.

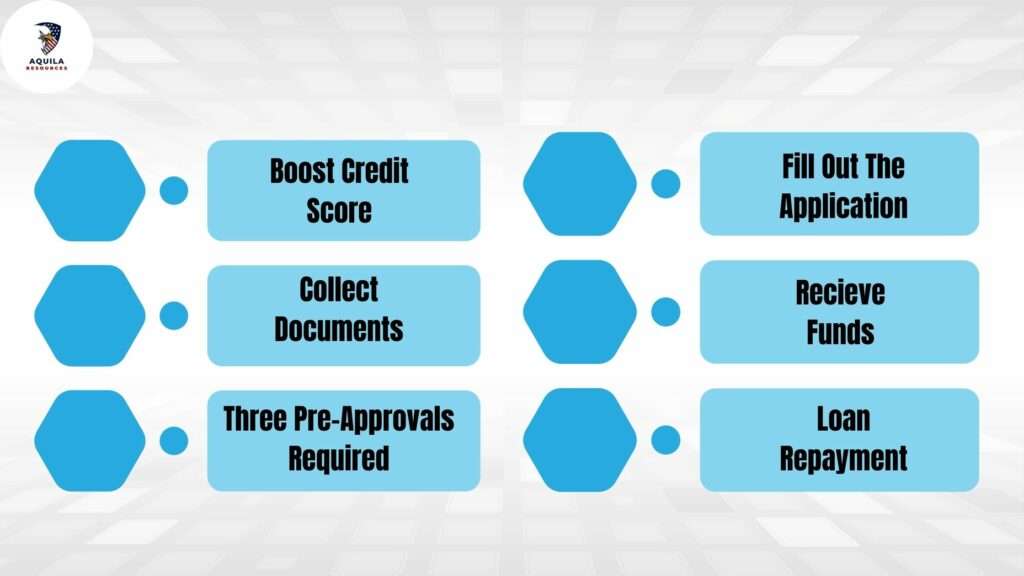

Boost Credit Score

Make sure your credit report is free of errors that could harm your financial future. You should also check your credit score and work on improving it.

Collect Documents

You can speed up the loan application process by creating a digital file with all the documents most lenders require. You will need to scan copies of your photo ID, recent tax returns, bank statements, pay stubs, and other proof of income.

Three Pre-Approvals Required

Several lenders allow you to check your rates and get a loan offer without submitting a full application. This does not affect your credit score, so you can find out what you need to know without affecting it.

Fill Out The Application

Choose your favorite lender and fill out the rest of the application. Watch your phone and email to ensure you can respond rapidly if your lender requests more information.

Recieve Funds

Once your loan application has been approved, your lender will send the funds to you. There are various ways to receive these funds, including ACH transfers, paper checks, and wire transfers. Your lender will be able to provide you with more details.

Loan Repayment

When you apply for the loan, you may be able to select autopay, but you may not be able to do so. Keeping your credit score strong will help you avoid late and missed payments.

How To Compare Installment Loan No Credit Check?

It is relatively easy to compare Installment Loan No Credit Check between lenders since most of them function the same way. Here are some factors to consider when comparing loans.

- APR stands for the annual percentage rate, which is the total cost of the loan.

- Customer reviews on websites such as the Better Business Bureau, Trustpilot, and J.D. Review websites to determine a lender’s reputation.

- It is very important to ensure that any potential lenders are licensed to conduct business in the state in which you reside.

- You should check your lender’s restrictions before using an installment loan for an unusual purpose.

- Identify the lenders with the best chances of qualifying based on your credit score.

- Make sure the lender allows you to use a co-signer, joint applicant, or offer collateral as loan collateral.

Alternatives of Installment Loan No Credit Check

Online Loans

Poor credit is considered by some online lenders, even if the credit score is below 600. Employer status and outstanding debts may be considered by some lenders in order to help you qualify. An Installment Loan No Credit Check typically haS higher interest rates, but they are rarely over 36%.

Joint or Co-signed Loans

If you have a low credit score, co-applicants with better credit profiles may be a good option. In a joint loan, a co-borrower shares repayment responsibility with the lender but cannot access the loan funds. Both cases involve your co-applicants responsibility for loan payments.

A Secured Loan

The credit requirements for secured loans are usually softer than those for unsecured loans, so those with fair or bad credit scores may qualify for a larger loan or lower interest rates on secured loans. Banks and credit unions prefer savings or investment accounts as collateral, while online lenders accept vehicles. Adding collateral may be beneficial, but it comes with the risk that it will be lost if you are late on your payments.

A Family Loan

You can ask someone you trust for help paying a bill, covering rent, or providing cash for groceries. Despite how difficult it may be, preserving your credit and keeping from entering into high-interest or payday loans is essential. You and your family can draw up a contract detailing the loan amount and repayment terms and how you will repay them.

Planned Payments

Inquire about a payment plan if an upfront reduction in a credit card bill, rent, utility bill, or mortgage payment would provide enough relief. Hardship forms are available from creditors and utility companies, but your landlord or lender may need to be contacted.

A Credit Union Loan

Many credit unions offer small personal loans starting at $500. You may be eligible without a credit score based on information other than your history as a member. The maximum interest rate for personal loans at federal credit unions is 18%. Some credit unions offer up to 28% AAPs for payday alternative loans (PALs).

Capital Good Fund

Applicants with thin or no credit histories can apply for emergency loans of up to $1,500 from the Capital Good Fund. Lenders do not have a minimum credit score requirement but will evaluate your past credit history. The Capital Good Fund also provides loans for the weatherization of homes and immigration expenses in some states. The Capital Good Fund offers consumer loans in states where it operates at rates ranging from 12% to 16%.

What is The Credit Check Process For Installment Loan No Credit Check?

You’re likely seeking an Installment Loan No Credit Check due to poor credit. But is that your only option? Long-term installment loan lenders often extend loan offers to people with bad credit even when they have bad credit.

There are a few things you should know if you’re considering an installment loan without checking your credit score.

A small loan amount – around $400 or less – is likely. In addition, the interest on the card will be higher than on a typical credit card. It is common for APRs to be around 35%, and some will even be higher. A payday loan repayment period is usually around three months, which is slightly longer than a regular loan.

FAQs

What is An Installment Loan No Credit Check?

You repay an Installment Loan No Credit Check with interest in (usually monthly) installments after borrowing a lump sum. It is possible to get a loan of $1,000 to $100,000 for a period of several years, with repayment terms ranging from a few months to several years.

What Are The Types of Installment Loan No Credit Check?

Loans that are repaid in smaller increments and borrowed all at once are installment loans. A personal loan, a student loan, a mortgage loan, or an auto loan are all examples of installment loans.

What Credit Score Do You Need For An Installment Loan No Credit Check?

Credit scores of at least 580 are required for decent an Installment Loan No Credit Check from major lenders. In order to qualify for a low APR and no origination fee on a personal installment loan, you’ll likely need a higher score.

Who is The Easiest Lender From Which To Get A Personal Loan?

The easiest lender for qualifying for a loan isn’t one in particular. Your credit score can increase your chances of being approved if you boost it as much as possible. Verify that there are no mistakes on your credit report that are affecting your score.

Conclusion

Bad credit borrowers have plenty of options when it comes to an Installment Loan No Credit Check. You can get pre-approved for a loan before selecting a lender from our curated list. Get at least three quotes to make sure you don’t take on more than you can afford.

Add Comment