Are you curious to know about the Best Prepaid Cards With High Spending Limits? You’re on the right page.

Prepaid cards are an excellent choice for those who don’t qualify for an unsecured credit card or other types of credit card. College students and young adults commonly use prepaid cards without a credit check to establish good financial habits without having to take on the financial responsibility associated with credit cards.

Prepaid debit cards are a great alternative to credit cards, checking accounts, or trouble getting bank accounts if you need one. However, the fees associated with prepaid cards can be rather high, so it’s hard to justify them against a free checking account. The best prepaid debit cards have relatively few fees, or they provide enough value to make the cost worthwhile.

The following are some considerations to consider when choosing Prepaid Cards With High Spending Limits.

Getting started is the first step.

What is A Prepaid Card?

Contents

- 1 What is A Prepaid Card?

- 2 How Does A Prepaid Card Work?

- 3 9 Best Prepaid Cards With High Spending Limits

- 4 How To Choose The Best Prepaid Cards With High Spending Limits?

- 5 How Do I Get Prepaid Cards With High Spending Limits?

- 6 Which Prepaid Card Has the Highest Limit?

- 7 How Much Do Prepaid Cards With High Spending Limits Cost?

- 8 Pros And Cons of Prepaid Cards With High Spending Limits

- 9 Why Use Prepaid Cards With High Spending Limits?

- 10 Fees Structure of Prepaid Cards With High Spending Limits

- 11 FAQs

- 12 Conclusion

Prepaid cards contain money that is preloaded on them. Credit and debit cards with these features usually look similar and function similarly but in a slightly different way. Bank accounts are typically linked to debit or credit cards. As opposed to a debit card, which is used to spend money already in your account, a credit card allows you to borrow money and pay it back later.

Prepaid cards are gift cards that do not require a bank account to purchase. Preloaded cards are available for purchase and can be topped up whenever needed. The coupons can be general or specific to a specific store or rewards program.

How Does A Prepaid Card Work?

Prepaid cards must be loaded with money before they can be used. Most credit cards allow you to top up your account online, but some also allow you to top up your account with cash.

The most common method for viewing and managing transactions is through an app – and you can use it to make purchases just like you would with any other debit card. Merchants accept taps or swipes, mobile wallets can add money, and withdrawals can be made.

9 Best Prepaid Cards With High Spending Limits

Below are several Prepaid Cards With High Spending Limits options that meet all of those criteria. However, since a prepaid debit card is not a credit card, it cannot be used to build or rebuild your credit score.

Brink’s Armored Account

For people who want to manage their finances and budget their spending, Brink’s Armored is a popular prepaid debit card option. The Brink’s ArmoredTM Account is one of its main benefits because it does not require a credit check. A low credit score or no credit history makes it ideal for those who don’t want to apply for a credit card. In addition to offering cashback rewards, this card also offers rewards for food and gas purchases, although the rewards are minimal. Adding multiple cards to the account is also an option so you can manage and track expenses for the entire family.

This card also comes with the following benefits:

- Track your spending activity with regular text alerts.

- Transferring money or finding reload locations with this mobile app

- Brinks Reduced Monthly Plan offers overdraft protection for small purchases.

- Invest in high-yield savings accounts through Brinks.

- Brink’s Money Prepaid Mobile App lets Netspend Cardholders send money online to friends and family at no additional charge.

PayPal Prepaid Mastercard

It offers a variety of features and can be easily integrated into your PayPal account through PayPal Prepaid Mastercard. The PayPal card allows users to transfer money directly from their PayPal account to the card. Moreover, the NetSpend Reload Network offers more than 130,000 locations nationwide where you can add cash, including direct deposits from paychecks and tax refunds.

There are some fees associated with this card, including monthly charges, ATM withdrawal fees, and reload fees at some retailers, but there are also special offers and payback rewards when you shop at the right stores. Your account will receive cash back if you choose to participate in this program.

This card also comes with the following benefits:

- Fund your prepaid card account with money from your PayPal account.

- Utilize your card to earn rewards and personalized offers.

- It’s faster to get paid with Direct Deposit than with a paper check.

- A Bancorp Bank credit card is FDIC-insured. You can use the card anywhere that accepts Debit Mastercard.

NetSpend Visa Prepaid Card

No bank account or credit score is required to initiate an account with the Netspend Visa Prepaid Card. The unique feature of Netspend is that it offers two different payment methods. There are two payment options: monthly fees or fees for every purchase. In terms of functionality, the NetSpend Visa Prepaid Card works similarly to its sibling card, which is ranked No. 2. It has a flat monthly maintenance fee that doesn’t change, which makes it different from the other cards. You can deposit up to $15,000 with both cards.

A lower fee may be available with the other card if you meet certain deposit and spending requirements. In general, you would have to meet those requirements to receive this card; however, if you do not, you may pay more than you normally pay for it. It might be a good option for those who do not spend a lot or do not benefit from direct deposits.

This card also comes with the following benefits:

- It’s faster to get paid with Direct Deposit than with a paper check.

- The card does not charge late fees or interest.

- Get alerts by text message or email using the Netspend Mobile App (Message & Data Rates apply).

- You must activate your card and verify your identity before you can use it. There are terms and costs involved.

- An FDIC-insured credit card issued by Pathward N.A. This card is accepted everywhere Visa debit cards are accepted.

Serve American Express

The Serve American Express Prepaid Debit Account is more than just a prepaid debit card; it boasts a deposit limit of $15,000.

The full account gives you access to direct deposit options, which allow you to get paid faster and safely store your savings.

A Serve card from American Express offers all the benefits of an American Express credit card without the hassle of applying for a traditional credit card and accruing interest charges. Choosing between three cards will help you find one with the features you need – a basic card with a waived monthly fee, a card with free cash reloads, and a card that earns 1% cash back.

American Express prepaid cards offer Reloadable Prepaid Cards With No Fees and cash back, which are features not available on most prepaid cards.

This card also comes with the following benefits:

- More than 37,000 MoneyPass® ATMs across the country offer FREE withdrawals.

- Early Direct Deposit gives you access to your money up to two days faster.

- You won’t be charged a monthly fee whenever you direct deposit more than $500 in a statement period.

- Paying your bills online can save you time and help you avoid late fees. The terms and conditions apply.

- Get SMS text alerts, view your balance, pay bills on the go, send money to family or friends with a Serve Account

Bluebird American Express

American Express developed the Bluebird by Walmart prepaid debit card in partnership with Walmart. Unlike many other services, it does not charge subscription fees, transaction fees, or activation fees. The service offers features such as direct deposit and online bill payment. Mobile check deposits and money transfers are also available via the app for account management.

With the American Express product, you’re protected against purchase fraud, roadside emergencies, and medical costs. MoneyPass ATMs offer free ATM withdrawals, and Walmart also offers free ATM reloads. Additionally, you can create subaccounts to manage your budget precisely and get emergency assistance 24/7.

This card also comes with the following benefits:

- Using an American Express® card anywhere, you can use a prepaid debit account.

- Direct deposit can speed up your paycheck by up to two days.

- You can shop with added confidence and Purchase Protection on purchases made with the card, which covers eligible purchases against accidental damage and theft for up to 120 days.

- You can access MoneyPass® ATMs for free at over 37,000 locations. Transferring money to other Bluebird Accountholders and adding cash to your account is free.

- If you have an emergency, Roadside Assistance can help coordinate and provide assistance to get you back on the road.

- You will not be charged a monthly fee or foreign transaction fee.

The Mango Prepaid Mastercard

There aren’t that many benefits offered by the Mango Prepaid Mastercard on its own. It is not possible to withdraw money for free from the ATM network, and ATM withdrawal fees begin at $3. You can earn an amazing interest rate on your savings once you have this card; however, you can earn up to 6.00% APY (as of Aug. 3, 2023) on your savings by adding a Mango Savings account.

A minimum balance of $25 is required in the Mango Savings account, as well as $1,500 per month in signature purchases (purchases that require a signature, not a PIN). The APY for purchases exceeding 750 in a month but not exceeding 1,500 will be 2.00% (as of May 23, 2023). A savings limit of $2,500 applies to these rates. A 0.10% APY is offered beyond that.

This card also comes with the following benefits:

- The mango app makes it easy for you to manage and access your money whenever and wherever you need it

- A prepaid card such as the Mango Card does not have hidden fees or interest charges. The fees and details of your Cardholder Agreement are available there.

- The Mango Card is accepted everywhere. Debit Mastercard is accepted.

- Your account can be managed from anywhere. You can securely send money to family and friends, check your balance, and view transaction history.

- Once you activate your Mango Card, you can open a Savings Account with just $25 and earn up to 6.00% APR if you withdraw up to six transfers per month.

Walmart MoneyCard

Green Dot Bank’s Walmart MoneyCard provides up to 3% cash back on Walmart.com purchases, 2% at Walmart fuel stations, and 1% at Walmart stores (total annual cashback is $75). There is also an option to open a savings account with a 2% interest rate on balances up to $1,000, along with the chance to win cash prizes.

You’ll pay $5.94 per month, which can be waived if you load $500 onto the card in the previous month. You can withdraw free cash at Walmart stores and ATMs in the MoneyPass network when you use the card. A Walmart MoneyCard app provides features like checking balances and managing funds, as well as depositing checks.

This card also comes with the following benefits:

- Direct deposits of $500 or more in the previous month will waive your monthly fee. A monthly fee of $5.94 will apply otherwise.

- You can earn 3% cash back at Walmart.com, 2% cash back at Walmart fuel stations, and 1% cash back at Walmart stores annually with Walmart Rewards, up to $75

- Savings account balances of up to $1,000 earn 2% interest. You’ll also get a chance to win cash prizes every month!

- Ensure peace of mind with three levels of coverage for purchases with opt-in & direct deposit eligibility.

ACE Elite Visa

There are plenty of standard features and benefits with the ACE Elite Visa Prepaid Debit Card, but there is also a laundry list of fees. ACE Elite’s prepaid debit cards can cost you even the most basic privileges, such as ATM withdrawals, purchases, and reloads.

This card offers one feature that stands out: a savings account that pays a staggering 5% APY. Balances above $1,000 are paid a low 0.50% APY. This rate is only valid on balances up to $1,000.

This card also comes with the following benefits:

- Reloadable prepaid cards for convenient money management

- Direct deposit can speed up your payment by up to two days.

- ACE offers no-fee cash withdrawals on regular Direct Deposits of up to $100

- You can earn cashback rewards at a few select retailers by using your card every day.

- Three card designs to choose from

- Tiered Optional Savings Accounts are available to cardholders. A current annual percentage yield of 5.00% is offered on balances up to $1,000.00. There is no minimum balance requirement.

Movo Virtual Prepaid Visa Card

A Visa debit card primarily designed for online use is a virtual card. A physical card costs $5.95. If you stay on the Visa Plus Alliance network, you won’t have to pay any monthly fees, transaction fees, or ATM fees with the card.

The card can be loaded with cash via direct deposit, bank transfers, debit cards, PayPal accounts, and money transfers at GreenDot locations (GreenDot may charge a fee). Visa ReadyLink locations also allow you to load cash, but there may be a fee.

This card also comes with the following benefits:

- A virtual Mastercard is now the only thing Movo Cash offers, unlike a Visa card.

- This mobile application combines functionality from a credit card and a bank account.

- Movo is an app that acts as a “prepaid” debit card, unlike a credit card.

How To Choose The Best Prepaid Cards With High Spending Limits?

Whether you decide to get Prepaid cards with High Spending Limits or not depends on your financial goals, spending habits, and general preferences.

Consider the fees associated with each card and how they might impact you. You may still want to consider a card if it offers enough value to offset the fees. There may not be a good fit if you cannot find a way to offset a card’s fees.

You don’t have to apply for more than one prepaid debit card. You can always switch to another one if one isn’t right for you after using it for a while.

How Do I Get Prepaid Cards With High Spending Limits?

Prepaid debit cards require no credit check or access to your credit score, so they are easier to get than credit cards.

Many prepaid cards can be bought over the counter at grocery and convenience stores. You can deposit money into your card account immediately after purchasing the card. Many of the best prepaid cards can also be applied for online.

You can load money on a prepaid card – and reload it – and spend up to your total balance as you like to make purchases wherever you choose. When creating your account with the card issuer, you may need to provide some personal information, including:

- Name

- Email and physical addresses

- Phone number

- A Social Security Number (even if some cards don’t require one)

You can create an account under your name with this information by verifying your identity with the card issuer. The account will function similarly to a bank account, where you can deposit and withdraw cash and accept direct deposits and cash checks.

After your prepaid debit card application is approved online, the card issuer will create your card. Your card account can be used as soon as you receive it in the mail, within seven to ten business days.

Which Prepaid Card Has the Highest Limit?

Some prepaid debit cards limit cardholder activity. For instance, a daily spending limit or an ATM withdrawal limit could restrict the money you can deposit into your account or withdraw.

In the same way, as with credit cards, you need to find a prepaid debit card whose limits won’t limit your spending.

Your direct deposit paycheck may not be deposited if your card has a low balance limit. The problem may also arise if you are a good saver and would like to build a nest egg.

How Much Do Prepaid Cards With High Spending Limits Cost?

The exact cost of prepaid debit cards varies depending on the issuer and how they are used. A typical fee structure includes initial purchase fees, monthly maintenance fees, cash reload fees and ATM withdrawal fees. Per-transaction fees are less common on some cards. There can also be foreign transaction fees of around 1% to 3% if the card is used internationally. The card may also charge inactivity fees if it is not used regularly, charges for customer service access and paper statements, and fees for replacing a card.

It is worth noting, however, that the best Prepaid Cards With High Spending Limits charge minimal fees and offer ways to keep costs low. Before purchasing a prepaid card, you need to review the terms and conditions as well as evaluate multiple options and ensure that you understand all fees that might apply.

Pros And Cons of Prepaid Cards With High Spending Limits

Pros of Prepaid Cards

- A prepaid card makes it easier for you to qualify for credit cards if you’re not likely to qualify for a credit card. Your credit history is not checked when you apply for a prepaid card.

- It is common for us to fall victim to special offers and deals. You may be able to get more rewards that way, which is a good thing, but avoiding overspending can be challenging. The set spending limit of a prepaid card is perfect for this situation. An impromptu shopping trip won’t lead to debt since all that can be spent is what you’ve already loaded onto the card.

- The convenience of traditional credit cards can also make them a liability. The convenience of plastic comes without the risk that you will default on your payments. Prepaid cards are a practical alternative to credit cards. The benefits of prepaid cards include the ability to shop virtually anywhere and not having to worry about late payments.

- As opposed to a debit card, if your card is stolen, the thief will only get access to your balance, not your entire checking account. You can still negatively impact your credit score even with a zero fraud liability credit card.

Cons of Prepaid Cards

- A prepaid card provides fewer protections than a credit card. Prepaid account consumers now have comprehensive protections, such as protections against errors, loss, or theft, and stricter rules to ensure issuers relay clear information about the fees associated with prepaid accounts. Prepaid cardholders should take advantage of these protections, even though they don’t quite compare with those of traditional credit cards.

- The three credit bureaus do not report any activity associated with prepaid cards since you are not borrowing money. You can still improve your credit history with prepaid cards, even though they don’t offer the same protections as credit cards. To boost your credit score, consider becoming an authorized user on someone else’s card or obtaining a secured credit card.

- It is important to be aware of any fees associated with prepaid cards before committing to one. A prepaid card may charge fees when the cardholder withdraws cash, reloads the card, or checks the balance.

Why Use Prepaid Cards With High Spending Limits?

Prepaid Cards With High Spending Limits are far simpler to get than opening a bank account or applying for a credit card. Prepaid cards are perfect for people with bad credit ratings because they do not exclude them.

Prepaid debit cards claiming to be the best no-fee cards have costs associated with them. The fees can quickly add up, so read the fine print carefully before signing up.

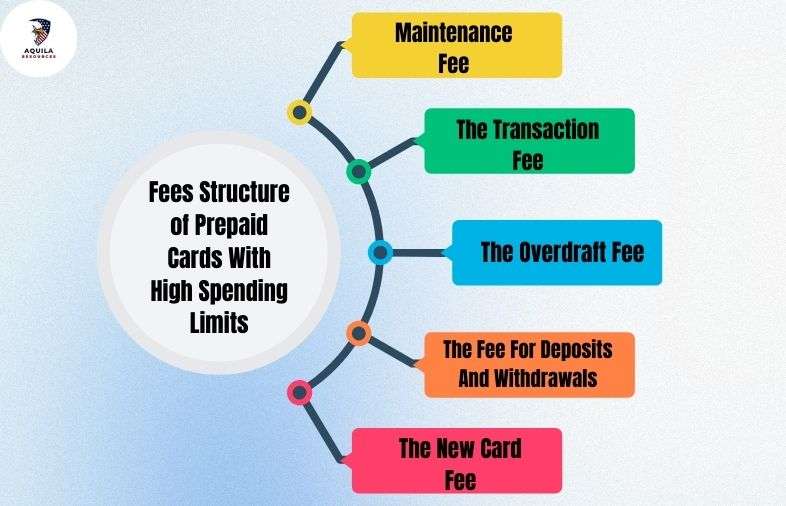

Fees Structure of Prepaid Cards With High Spending Limits

Several fees are associated with Prepaid Cards, but many offer reloadable cards and accounts.

The following are some examples of fees that your card issuer may charge. If you plan on applying for a card, study the disclosure document to ensure you know what the costs will be.

Maintenance Fee

The card issuer may charge you a monthly maintenance fee for maintaining your account. Your monthly fee may vary depending on the card type, but receiving direct deposits into your account may qualify you for a reduced or waived fee.

The Transaction Fee

You can use a prepaid debit card for several types of transactions, and some of them may cost you money. An ATM operator may charge you a fee for withdrawing money or making a purchase. The fee may also apply if you use an ATM device to check your balance or add money to your account.

The Overdraft Fee

The amount you deposit into your prepaid card is usually the most you can spend. If you go beyond your account balance with a card that allows you to exceed your balance, you may be charged an overdraft fee. Overdraft protection may also reduce overdraft fees.

The Fee For Deposits And Withdrawals

When you use an ATM or reload location to withdraw money from your account, you may incur charges, such as ATM withdrawal fees. Reload fees may also apply to cash deposits or mobile check deposits.

The New Card Fee

Card issuers may charge you a fee when they create your first card or send you a replacement. Prepaid Visa cards or Visa debit cards purchased in a storefront are subject to a fee, similar to prepaid cards.

FAQs

How Do I Get A Prepaid Debit Card?

Prepaid cards can be bought online, at certain retailers, or at some banks and credit unions.

Are Prepaid Debit Cards Worth It?

It is convenient to use prepaid debit cards because you do not need a checking account with a bank. It can also be useful for budgeting and staying out of debt since you can’t exceed your deposit. Prepaid debit cards can be used for certain spending categories, such as coffee and groceries, even if you already have a standard debit card.

How Do You Put Money On Prepaid Cards?

Depending on which issuer you choose, you can load money onto prepaid cards in several ways. Some issuers offer in-person cash deposits at financial institutions, while others offer in-person cash deposits at retailer locations that participate in the program. Most issuers can also load prepaid cards online from a checking or savings account.

How Much Money Can You Put On A Prepaid Card?

It is common for prepaid cards to limit the amount you can load onto them each day and the amount you can spend each day. These limits can differ between cards, so check with your card issuer if you value this feature highly.

Do All Prepaid Cards Require A Social Security Number?

Prepaid debit cards usually require you to provide a Social Security number. Credit card issuers may check your banking history, even though this information won’t be used for credit checks. The majority of prepaid debit cards do not require a Social Security number, but they are rare.

How Much Money Can You Put On A Prepaid Card?

The limit on a prepaid debit card is usually relatively low. There is a range of daily deposit limits on the cards we evaluated, and some have a maximum deposit limit, generally between $10,000 and $20,000. You should know what limits apply before selecting a card.

Conclusion

Prepaid Cards With High Spending Limits can be used for various reasons. You can easily use a prepaid card to avoid overspending, for instance. The downside is that they do not help you improve your credit score or provide the same level of consumer protection as credit cards.

Add Comment