Are you curious to know how to Transfer Money From GreenDot To Chime Account? Your search ends here.

It is possible to transfer money from GreenDot to Chime Account. Transferring money from and to Greendot or Chime accounts is easy.

It is also possible to send money to two banks with the same account using GreenDot and Chime.

The problem is that many people aren’t always sure how to Transfer Money From GreenDot To Chime Account, which is why we’re going to show you how to Transfer Money From GreenDot To Chime Account.

Let’s get started.

What Is Chime?

Contents

- 1 What Is Chime?

- 2 What is GreenDot?

- 3 Does Chime Work With Green Dot?

- 4 How To Transfer Money From GreenDot To Chime Account?

- 5 Different Ways To Add Money To Green Dot Account

- 6 Pros and Cons of GreenDot?

- 7 Pros and Cons Of Chime?

- 8 How Do Chime and Green Dot Provide Customer Service?

- 9 Is Chime a Better Choice Than Green Dot?

- 10 What is the Best Way To Send Money To Other Green Dot Users?

- 11 FAQ

- 11.1 Can I Transfer Money from a Prepaid Card to Chime?

- 11.2 Can one Transfer Money From GreenDot To Chime Account without paying a fee?

- 11.3 Are There Any Other Ways to Deposit Money to Chime Besides GreenDot?

- 11.4 How Long Does it Take to Transfer Money From GreenDot To Chime Account?

- 11.5 Does Chime Have the Maximum Amount You Can Transfer from GreenDot?

- 12 Conclusion

The Chime app streamlines tax returns, unemployment benefits, paycheck deposits, and government stimulus payouts. Send money to friends and family, view account balances, receive balance notifications, and receive transaction alerts.

What is GreenDot?

As the world’s largest prepaid debit card company, Green Dot Corporation is an American financial technology and bank holding company based in Austin, Texas. The technology platform used by Apple Cash, Uber, and Intuit was developed by Green Dot. Steve Streit founded the company in 1999 to offer teenagers an online shopping experience with Best prepaid debit cards for teens.

Does Chime Work With Green Dot?

Yes, You can use Chime and Green Dot together. You can Transfer Money From GreenDot To Chime Account. The Chime can also be linked directly to the Green Dot. The Chime service is a component of the larger Green Dot network. It is even possible to link both accounts.

How To Transfer Money From GreenDot To Chime Account?

It takes just a few minutes to Transfer Money From GreenDot To Chime Account. You can open a Chime account in only five steps without paying any hidden fees or incurring expensive overdraft fees.

You will be able to transfer your money in no time at all by following these steps:

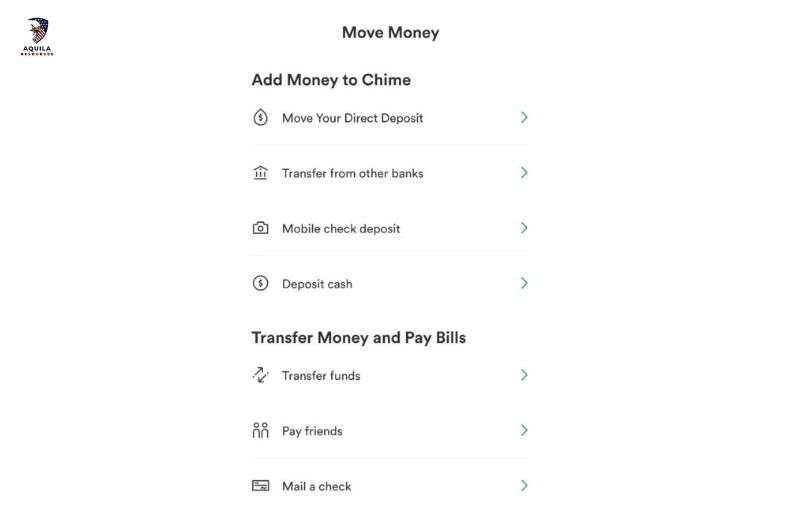

- Use the Chime App on your cell phone or log into your Chime account online.

- Choose “Move Money” from the menu.

- Select “Transfers” from the menu.

- Provide your Green Dot login credentials when prompted. Chime and Green Dot are partners, so this login is safe.

- Green Dot’s online platform will link to your Chime account once you log in. Using this link, you can access your Green Dot funds through your Chime debit card.

Chime is technically a part of Green Dot’s banking network. Your Chime account will receive all of your funds if you link your Green Dot account and Chime account together. To save money on service fees, you may want to close your Green Dot account after you have spent the money from it.

Chime can consolidate all your funds within a few clicks and moments of your time.

Different Ways To Add Money To Green Dot Account

The most important thing you can do with your card is add money to it. It is not possible to use the card as it is without money in your account. Your account can be credited in various ways. The following are some of them:

Make Multiple Reloads

It is possible to load your account with Green Dot without issues because several retailers work with them. The cashiers will assist you if you bring your card and cash.

Other People’s Money

When you send other Green Dot card holders your mobile phone number and email address, they will be able to send you money quickly.

The Direct Deposit Method

You can also deposit money into your account via direct deposit. As a result, you will be able to settle your issues as early as possible since you will receive your payment two days earlier. A government benefit recipient can receive his or her check four days earlier than expected.

A Mobile Check Deposit App

Your account can be credited with checks by Green Dot. In order to start using Green Dot, you just need to download it, depending on your phone. The deposit of a check can be made by signing the back of the check, taking a photo, and uploading the photo for verification.

Pros and Cons of GreenDot?

Pros

- Select online purchases can earn you 2% cash back

- Overdraft fees do not apply

- No minimum balance is required

- You won’t have to submit a credit check to apply for the platinum card

- Savings account with high APY

Cons

- You may not be able to waive the monthly fee if you cannot afford it

- You can’t earn cash back on all types of transactions

- A joint account does not exist

- ATM fees outside of the network are $3

Pros and Cons Of Chime?

Pros

- The Chime SpotMe service allows you to overdraft up to $200 without incurring fees.

- There is no minimum balance requirement.

- There are no monthly fees.

- Plans that automatically save money.

- Paychecks are deposited up to 2 days early.

- The Chime app makes it easy to track spending and saving.

- Protect your card from fraud and lost or stolen transactions with a Visa debit card. Visa is accepted everywhere.

Cons

- Monthly deposits to your account are limited. When you work hard and want to save a lot, this can be frustrating.

- ATM transactions outside Chime Bank’s network are charged $2.50.

- There are no physical branches for Chime Bank, so if you prefer to do your banking in person, this might not be the right bank for you.

How Do Chime and Green Dot Provide Customer Service?

Customers can access various financial features through Chime and Green Dot.

The two companies do differ, however, when it comes to customer service.

A comprehensive FAQ section is available on Chime’s website, along with live chat, phone, and email customer support. Besides offering 24/7 customer support, Green Dot also offers email and phone support.

As well as being less user-friendly, Green Dot’s website provides less information than Chime’s. If you need assistance with your account or have questions about Chime’s services, Chime is the better option.

Is Chime a Better Choice Than Green Dot?

Free of Charge

Green Dot and Chime have several advantages over each other. Chime provides a free alternative to conventional banking through its online platform and services. Fees are charged by Green Dot in addition to transaction and maintenance fees.

Monthly Fee-Free

The majority of Green Dot’s items have a $5 minimum monthly service fee, despite the fact that some items are free of charge. On the other hand, Chime doesn’t charge a monthly fee for any of its services.

The Service is Free

You can access over 60,000 banks across the globe using Chime without paying any fees. The Visa Plus Alliance and 7-Eleven stores offer ATMs for some institutions. Your daily life is made easier by these ATMs. Additionally, you can get cash from stores as well as use ATMs at large bank offices for all of your financial needs.

ATMs Without Fees

All 7-Eleven outlets, as well as Walgreens and CVS Pharmacy locations, offer fee-free ATMs for Chime members. It’s easy and convenient to bank with Chime since these businesses are spread all over the country.

Using SpotMe

Customers using Chime can withdraw up to $200 of money using overdraft protection through SpotMe’s SpotMe feature. The overdraft protection offered by SpotMe can be helpful to a lot of people in an emergency.

Moving your money to Chime and closing your old bank account is the best way to save on fees, overdraft protection, and minimum payments.

What is the Best Way To Send Money To Other Green Dot Users?

It is easy to send money from your account to another Green Dot user.

It’s as simple as accessing your app online.

It is necessary to have the recipient’s cell phone number or email address in order to complete the transfer. They will use the funds as soon as they receive them.

Moreover, the money is transferred instantly, so the recipient is able to use it as soon as it is received. The following steps are involved in sending money to someone else:

- Go to People and Bills after logging in.

- Send money by choosing Pay People.

- You will need to enter the name, email address, and phone number of the recipient. Then, write a memo and include the amount.

- You can now select Send Money to complete your transaction once you have reviewed the information.

FAQ

Can I Transfer Money from a Prepaid Card to Chime?

It is not possible to transfer money from a prepaid card to Chime. Chime only accepts bank transfers from accounts that it accepts. The number of banks supported by Chime is limited.

Can one Transfer Money From GreenDot To Chime Account without paying a fee?

No fee is charged for moving money between Greendot and Chime. It is a free transaction for both the sender and the recipient.

Are There Any Other Ways to Deposit Money to Chime Besides GreenDot?

Yes, of course. The cash app can be used to transfer money to Chime with an extra effort, as described above. Retailers like Walgreens and Walmart also accept deposits into Chime spending accounts.

How Long Does it Take to Transfer Money From GreenDot To Chime Account?

There are different types of transfers. It can take longer than 5 business days if you use the indirect transfer method. It may take up to five business days if you initiate a direct Transfer Money From GreenDot To Chime Account. Direct transfers initiated through GreenDot accounts can take up to three business days.

Does Chime Have the Maximum Amount You Can Transfer from GreenDot?

Yes, of course. There is a maximum transfer limit for Chime. The Chime app only supports ACH transfers initiated via the app. This method of transfer had a daily and monthly limit of $1000 and $25000, respectively. Transfers initiated through the GreenDot account do not have an amount limit with Chime. It is up to GreenDot to decide.

Conclusion

The money you invest can be in a team-oriented, safe, and comfortable company within a couple of minutes. Your money is protected by Chime from all services and overdraft fees, unlike traditional institutions. Further, Chime does not require accounts to maintain a minimum balance or to have regular deposits. There are no fees or ongoing responsibilities associated with your money or account. Green Dot nevertheless charges transaction fees for its Pay As You Go Visa Debit Card.

Add Comment